Back-to-Back Weekly Hammer Candles in Bitcoin: A Closer Look

Bitcoin, the world’s most famous digital currency, has recently shown something unusual on its price charts: back-to-back weekly hammer candles. This might look interesting, but it also means something important for people who trade or invest in Bitcoin. Let’s find out what these hammer candles are, why they’re rare, and what they might tell us about Bitcoin’s future.

What are Hammer Candles?

A hammer candle is a special kind of candlestick pattern. It looks like a hammer because the wick (the line above or below the body) is much longer than the body itself. This usually happens when the price moves a lot in one direction but then changes and moves back in the other direction. People often see this as a sign that the market might be changing direction.

Hammer Candles in Bitcoin’s History

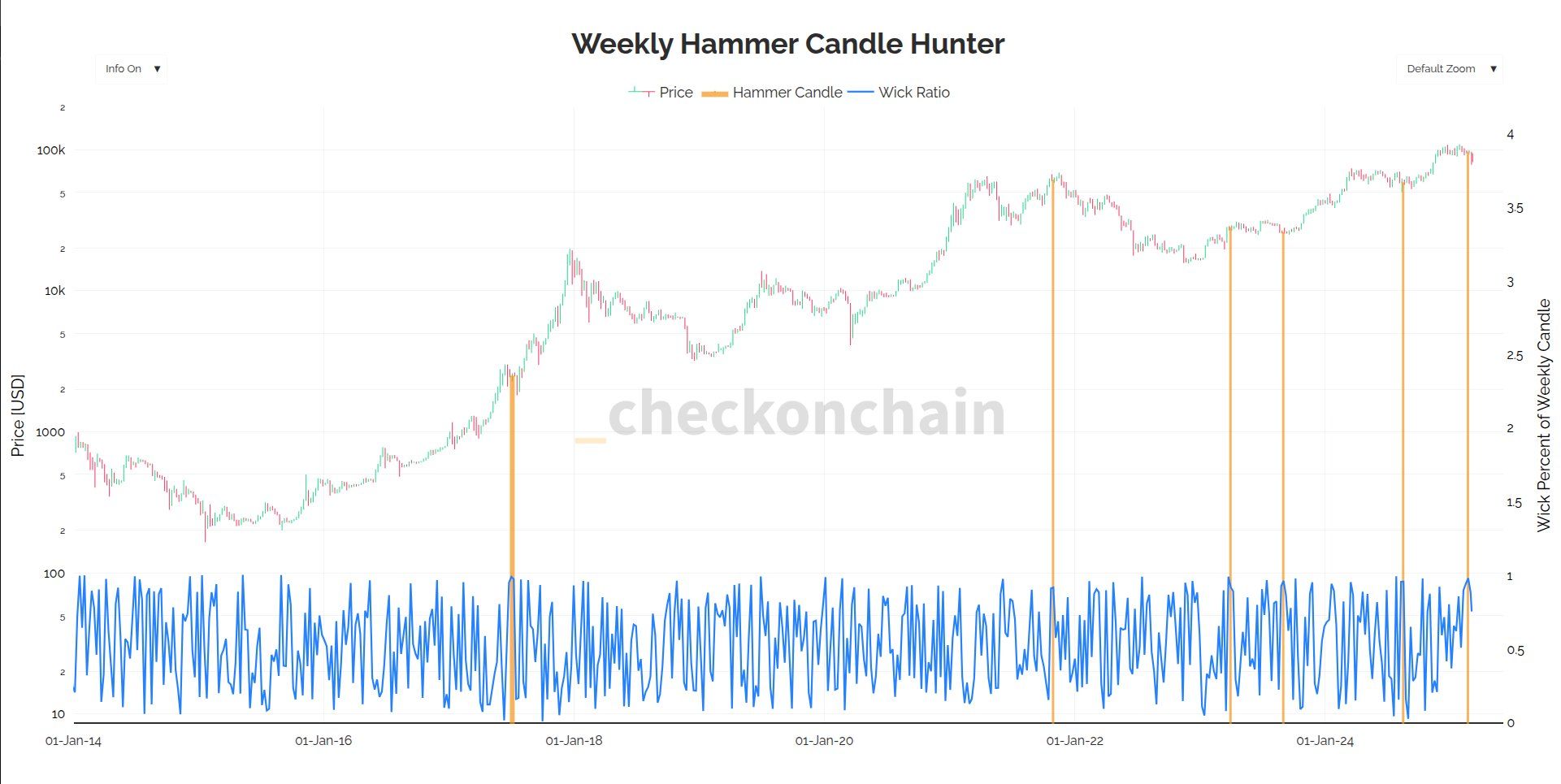

Checkmate, a company that studies the Bitcoin market, found that Bitcoin has only had a weekly hammer candle with a very long lower wick (90% or more) five times in its history[1]. These times were important: during a big price rise in 2017, at the peak of a bull market in late 2021, and twice in 2023 after some market troubles. The last time was in 2024 during a quiet summer period. Because this pattern is so rare, it might be a big change in Bitcoin’s price trend.

Recent Price Swings and Market Talk

In the past two weeks, Bitcoin’s price has gone up and down a lot – 23% in one week and 16% in the next[1]. This shows how volatile Bitcoin can be. Even though the price is moving around, CryptoQuant’s CEO, Ki Young Ju, thinks Bitcoin is still in a bull cycle, which means its price is likely to go up over time. He even thinks a drop to $77,000 wouldn’t end this cycle[2].

What This Means for Investors

Seeing back-to-back hammer candles might mean Bitcoin’s price could change direction or stabilize. But remember, other things can also affect the price, like support levels. For example, people who invested in U.S. Bitcoin ETFs have a cost basis of $89,000, which is a strong support level[2]. Also, if the price falls below $57,000, Bitcoin miners might start losing money, which has happened at the start of bear markets in the past[2].

Conclusion: A Strong Signal in Volatile Times

In short, back-to-back weekly hammer candles in Bitcoin are rare and important. They don’t guarantee what will happen, but they can tell us when something big might be about to change in the market. As Bitcoin keeps going through ups and downs, understanding these patterns can help investors and traders make better decisions. Whether Bitcoin is about to go back up or keep going down, these hammer candles are a strong signal that we should pay attention to in the ever-changing world of cryptocurrency.

—