Navigating the Cryptocurrency Market: A Deep Dive into Trends, Analysis, and Opportunities

Introduction: The Ever-Evolving Crypto Landscape

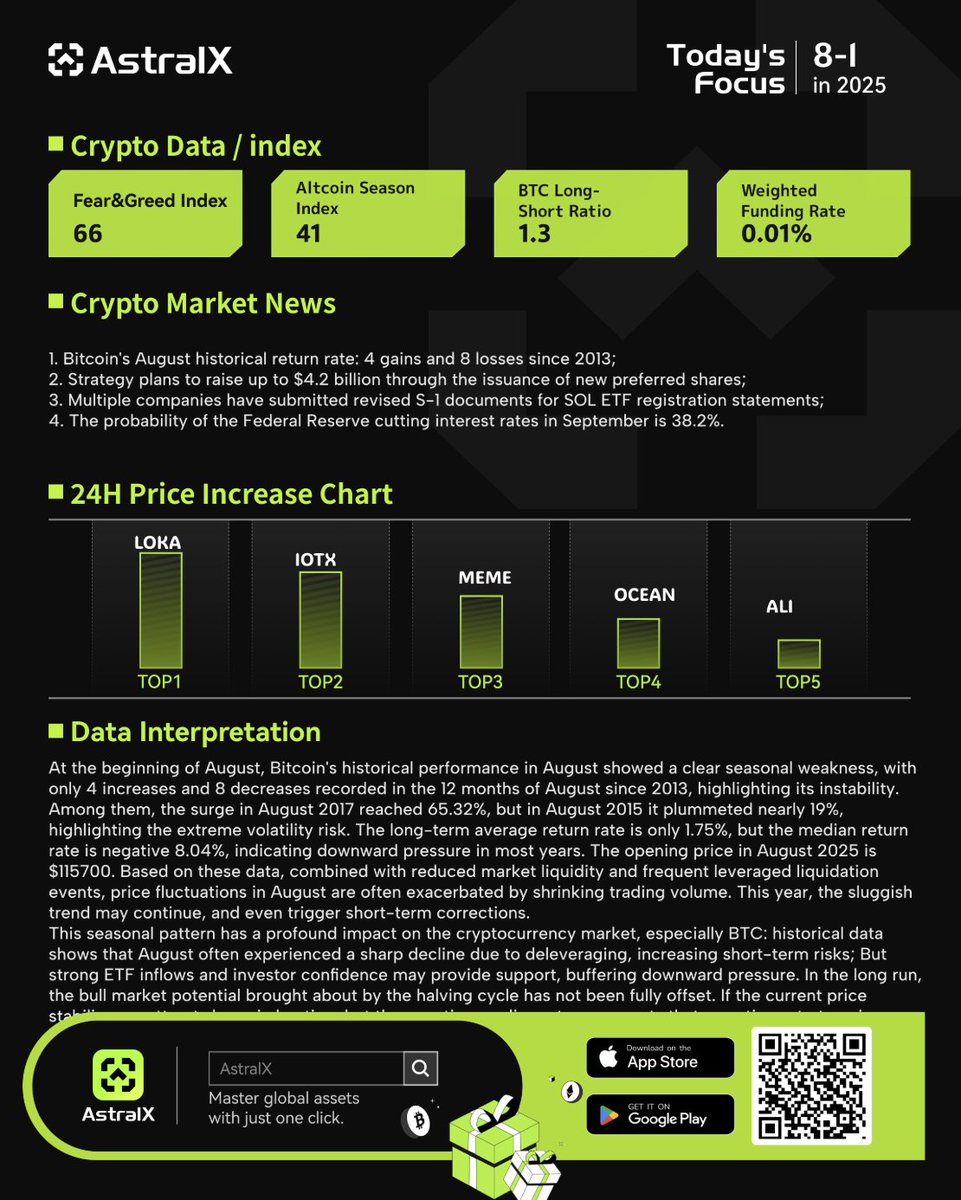

The cryptocurrency market remains one of the most dynamic and unpredictable financial arenas, characterized by rapid price movements, technological advancements, and shifting investor sentiment. As we move through August 2025, the market continues to present both challenges and opportunities for traders, analysts, and enthusiasts alike. This report explores key trends, technical analyses, and strategic insights derived from recent market activity.

Market Sentiment and Key Movements

Bitcoin’s Volatility Sparks Discussion

Bitcoin (BTC), the flagship cryptocurrency, recently dipped below the $113,000 mark, triggering debates among investors and analysts. This movement highlights the inherent volatility of the crypto market, where sudden shifts can redefine trading strategies and market sentiment. The price drop has led to increased scrutiny of BTC’s short-term outlook, with some traders capitalizing on scalping opportunities while others adopt a more cautious approach.

Ethereum’s Bearish Sentiment Persists

Ethereum (ETH) has been trading within the $3,475–$3,539 range, with analysts advising caution due to lingering bearish sentiment. Despite occasional rallies, the broader market remains skeptical, waiting for clearer signals before making significant moves. This cautious stance reflects broader market uncertainty, where even the most established altcoins are not immune to downside risks.

Technical Analysis: Key Cryptocurrencies Under the Microscope

BEAMX/USDT: A Mixed Performance

Beam (BEAMX) has shown a slight 24-hour increase but remains down significantly year-to-date (-73.77%). However, its 60-day performance (+8.08%) suggests some short-term recovery potential. Traders should monitor key support and resistance levels to identify potential entry and exit points.

FIDA/USDT: Volatility and Short-Term Gains

Solana Name Service (FIDA) has experienced a 30-day surge of +42.80%, though its year-to-date performance remains negative. The recent volatility presents opportunities for swing traders, particularly if FIDA can maintain momentum above critical support levels.

MINA/USDT: A Downtrend with Short-Term Upside

Mina (MINA) is currently trading at $0.1775, with a year-to-date decline of -69.04%. Despite this, recent price action suggests a short-term rebound may be possible. Traders should watch for bullish reversal patterns before committing to long positions.

AAVE/USDT: A Strong Long-Term Outlook

Aave (AAVE) is showing bullish potential, with a recommended long-term swing trade strategy. Entry points are identified between $239.02 and $196.38, with target areas at $312.80, $382.60, and $470.70. A stop-loss at $150.97 is advised to manage risk effectively.

Emerging Trends and Strategic Insights

Institutional Adoption: The Next Bull Run Driver

Charles Hoskinson, founder of Cardano, has highlighted two key factors that could drive the next major bull run: institutional adoption by tech giants (referred to as “MAG7”) and the mainstreaming of cryptocurrency. This suggests that as traditional finance continues to integrate with Web3, we may see sustained upward momentum in the crypto market.

AI and On-Chain Analysis: The Future of Trading

Platforms like Surf_Copilot are leveraging AI to simplify Web3 interactions, offering real-time crypto signals, on-chain data analysis, and automated actions. This trend indicates that AI-driven insights will play an increasingly crucial role in trading strategies, helping investors make data-backed decisions in an otherwise unpredictable market.

The Rise of AttentionFi: Rewarding Influence in Crypto

The growing popularity of Wallchain.xyz highlights the emergence of AttentionFi, a model that rewards real influence in the cryptocurrency space. By tracking and amplifying impact through LLM analysis, this platform demonstrates how social engagement and content quality are becoming valuable assets in the crypto ecosystem.

Conclusion: Staying Ahead in a Dynamic Market

The cryptocurrency market in August 2025 remains as volatile and opportunity-rich as ever. While Bitcoin and Ethereum continue to dominate headlines, altcoins like BEAMX, FIDA, and MINA present unique trading opportunities for those willing to analyze technical patterns and market sentiment. Institutional adoption, AI-driven insights, and the rise of AttentionFi are reshaping the crypto landscape, offering new avenues for growth and innovation.

As the market evolves, staying informed, adaptable, and risk-aware will be key to navigating its complexities. Whether you’re a seasoned trader or a newcomer, understanding these trends will help you make smarter, more strategic decisions in the ever-changing world of cryptocurrency.

—

Sources: