The Lummis Offensive: Unpacking the Senator’s Battle with the Federal Reserve

Introduction: A Clash of Perspectives

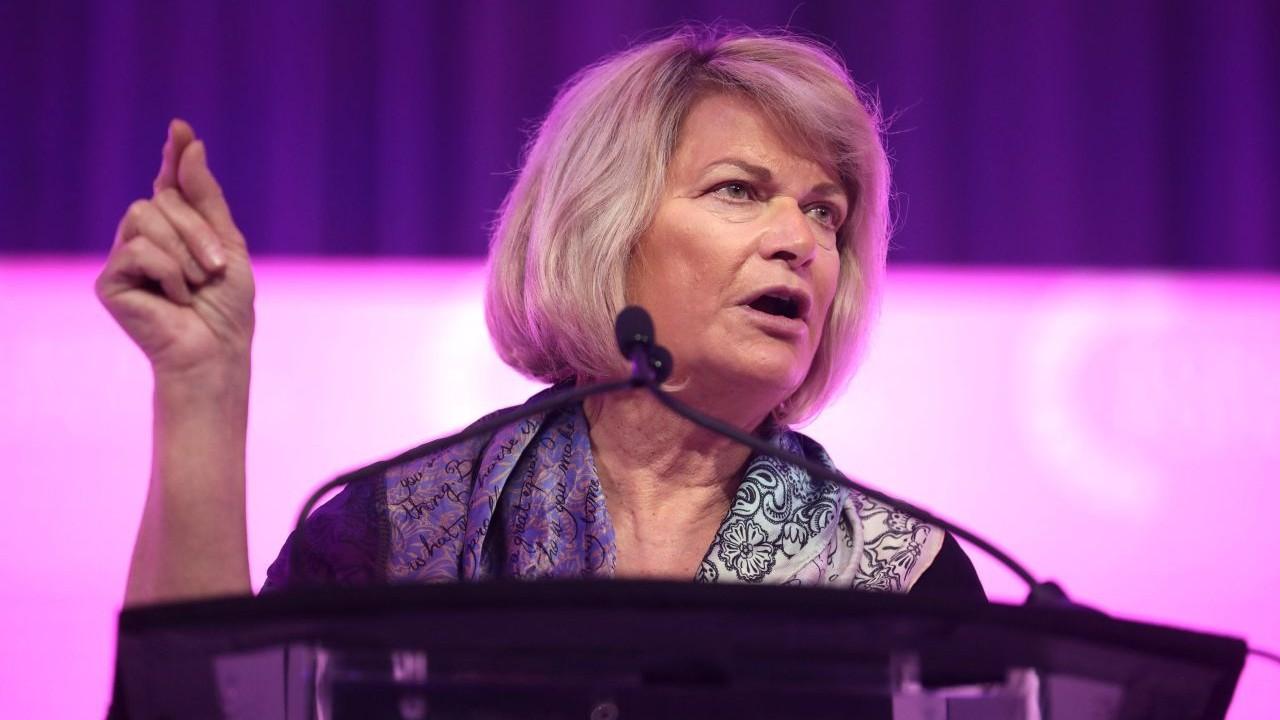

The intersection of politics, finance, and technology has rarely been more contentious than in the current debate surrounding the Federal Reserve’s role in regulating digital assets. At the heart of this debate stands Senator Cynthia Lummis, a Republican from Wyoming, who has emerged as a vocal critic of the Fed’s transparency and its approach to cryptocurrency. Her criticisms, delivered with a blend of sharp rhetoric and legislative action, have sparked a broader conversation about the balance between central bank independence and congressional oversight. This analysis explores the core of Lummis’s concerns, the specific issues she raises, and the broader implications of her ongoing battle with the Fed.

The “Black Hole” Accusation: A Call for Transparency

Senator Lummis’s most striking accusation is that the Federal Reserve operates as a “giant black hole of accountability.” This analogy is not merely a rhetorical flourish; it encapsulates a deep-seated concern about the Fed’s perceived lack of transparency. Lummis argues that the Fed “consumes information, but never releases it,” creating a barrier to effective oversight. This lack of transparency, she contends, makes it difficult to hold the Fed accountable for its actions and decisions.

The “black hole” analogy extends beyond the mere withholding of information. It suggests a system where information is either obscured or interpreted in ways that align with the Fed’s agenda, rather than being presented in a clear and unbiased manner. This opaqueness, Lummis argues, prevents a proper understanding of the Fed’s decision-making processes and makes it harder to assess the impact of its policies. Her critique raises fundamental questions about the Fed’s commitment to openness and its responsiveness to the legislative branch.

Digital Asset Regulation: Accusations of Bias

A significant portion of Lummis’s critique focuses on the Fed’s approach to digital assets, particularly its handling of cryptocurrencies like Bitcoin. She has voiced concerns about a perceived bias against the crypto industry, citing the Fed’s continued failure to repeal the Policy Statement on Section 9(13) of the Federal Reserve Act. This policy statement has been interpreted as creating obstacles for banks seeking to provide services to crypto-related businesses. Lummis believes this policy creates an uneven playing field and stifles innovation within the digital asset space.

The debate over digital asset regulation highlights a broader tension between innovation and oversight. On one hand, cryptocurrencies and blockchain technology have the potential to revolutionize financial systems and create new economic opportunities. On the other hand, there are legitimate concerns about consumer protection, money laundering, and the potential for illicit activities. Lummis advocates for a more balanced approach that fosters innovation while addressing these risks. Her stance reflects a growing recognition of the need for regulatory clarity in an evolving financial landscape.

Demanding Answers: Formal Requests and Public Scrutiny

Lummis has taken a proactive approach in her pursuit of greater transparency from the Fed. As chair of the Senate Banking Subcommittee on Digital Assets, she has sent formal document requests to the Federal Reserve Board of Governors and the Federal Reserve Banks of Dallas and Richmond. These requests set deadlines for responses and explicitly state that claims of privilege or confidentiality do not exempt the agency from answering. This aggressive approach demonstrates her commitment to holding the Fed accountable and bringing its actions under public scrutiny.

By publicly challenging the Fed and demanding specific information, Lummis aims to shed light on the inner workings of the central bank and force it to justify its policies and practices. This strategy also serves to raise public awareness about the issues at stake and to galvanize support for greater transparency and regulatory clarity. Her actions are not merely about seeking information; they are about using that information to shape the narrative and influence the policy debate.

Questioning the Fed’s Crypto Banking Rule Withdrawal

Despite the Fed’s withdrawal of certain crypto guidance, Lummis remains skeptical, characterizing the move as “just noise, not real progress.” This statement reveals a deep-seated distrust of the Fed’s intentions and a belief that superficial changes are insufficient to address the underlying issues. Lummis’s skepticism suggests that she believes more fundamental reforms are needed to ensure a fair and transparent regulatory environment for digital assets.

Her reaction to the withdrawal of crypto guidance underscores the importance of follow-through and tangible action. It is not enough for the Fed to simply announce changes; it must demonstrate a genuine commitment to creating a level playing field for the digital asset industry. Lummis’s persistence in holding the Fed accountable for its promises ensures that the conversation about regulatory reform remains at the forefront of the policy agenda.

The Bigger Picture: Congressional Oversight and the Fed’s Independence

Lummis’s battle with the Fed raises fundamental questions about the relationship between Congress and the central bank. The Fed is designed to be independent, insulated from short-term political pressures, to make decisions in the long-term interest of the economy. However, this independence is not absolute. Congress has the power to oversee the Fed, to hold it accountable, and to shape its mandate through legislation.

Lummis’s actions can be seen as an assertion of congressional authority over the Fed, a reminder that the central bank is ultimately accountable to the elected representatives of the people. Her efforts to increase transparency and challenge perceived biases are aimed at ensuring that the Fed operates in a manner that is consistent with the public interest and that its decisions are subject to proper scrutiny. This dynamic highlights the delicate balance between central bank independence and democratic accountability.

The Potential for a Broader Crypto Agenda

While the core of Lummis’s critique centers on the Fed’s transparency and regulatory approach, there is a broader undercurrent suggesting an agenda to promote the adoption and integration of cryptocurrencies into the financial system. Her vocal support for Bitcoin and her efforts to create a more favorable regulatory environment for digital assets align with a vision of a future where cryptocurrencies play a more prominent role in the economy.

Lummis’s advocacy for digital assets extends beyond simply challenging the Fed. It encompasses efforts to educate her colleagues about the potential benefits of cryptocurrencies, to promote responsible innovation, and to create a regulatory framework that encourages growth while addressing risks. Her efforts, therefore, are not just about criticizing the Fed, but about shaping the future of finance. This broader agenda reflects a recognition of the transformative potential of digital assets and the need for a forward-looking regulatory approach.

Conclusion: A Continued Watchdog Role

Senator Cynthia Lummis’s relentless pursuit of transparency and accountability from the Federal Reserve positions her as a key watchdog in the ongoing debate over monetary policy and digital asset regulation. Her “black hole” accusation, her demands for information, and her skepticism towards the Fed’s actions highlight the importance of congressional oversight and the need for a balanced approach to innovation and regulation. Whether her efforts will ultimately lead to significant changes in the Fed’s practices remains to be seen, but her vocal and persistent challenge ensures that these issues remain at the forefront of the policy agenda. The Lummis offensive is far from over, and her continued scrutiny will undoubtedly shape the future of the relationship between Congress, the Federal Reserve, and the burgeoning world of digital assets.