Navigating the Cryptocurrency Market: Insights from August 2025

Introduction: A Market in Flux

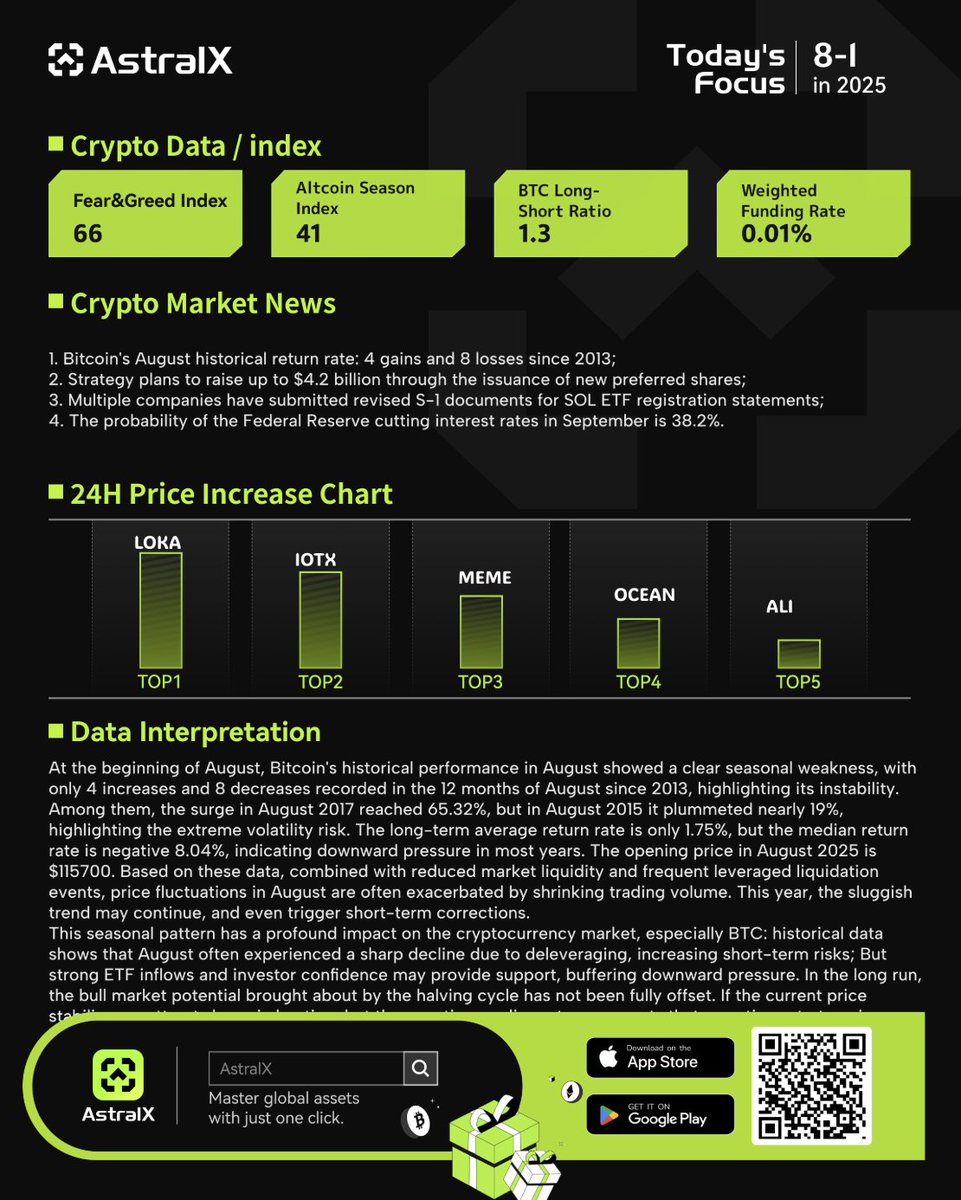

The cryptocurrency market remains one of the most dynamic and unpredictable financial landscapes, characterized by rapid price swings, institutional shifts, and evolving trends. As we delve into August 2025, key developments—such as Bitcoin’s volatility, institutional adoption, and emerging altcoin trends—are shaping the market’s trajectory. This report provides a detailed analysis of the current state of the crypto market, highlighting major trends, potential opportunities, and risks.

—

Key Drivers of the Next Bull Run

1. Institutional Adoption by Tech Giants (MAG7)

Charles Hoskinson, founder of Cardano, recently emphasized that institutional adoption by major tech companies—referred to as the “MAG7″—could be a significant catalyst for the next cryptocurrency bull run. The MAG7, which includes industry leaders like Apple, Microsoft, and Google, has shown growing interest in blockchain technology and digital assets. Their involvement could bring massive liquidity and legitimacy to the crypto space, potentially driving prices higher.

2. Altcoin Season and Emerging Opportunities

According to ChatGPT’s dynamic market analysis, August 2025 is a critical period for altcoin allocation. Investors are closely monitoring potential breakout coins before the next altcoin bull market. Projects like Janicetoken and PENGU have gained attention, with the latter being the first penguin-themed cryptocurrency on the BNB Chain. Smart money movements suggest growing interest in niche meme coins, which could see significant price surges if market sentiment shifts favorably.

—

Bitcoin’s Volatility: A Double-Edged Sword

1. Recent Price Movements

Bitcoin (BTC) has experienced significant volatility in recent weeks, with prices fluctuating between $114,000 and $116,000. A notable drop below $114,000 raised concerns among investors, while a subsequent surge past $116,000 reignited bullish sentiment. This volatility underscores the importance of technical analysis in navigating short-term price movements.

2. On-Chain Analysis and Market Sentiment

Data from Sentora, a leading DeFi analytics platform, suggests that Bitcoin may face further downward pressure due to whale movements and selling pressure. However, historical trends indicate that corrections often precede major rallies, making this period crucial for strategic positioning.

—

Altcoin Spotlight: Opportunities and Risks

1. Meme Coins and Speculative Trends

Meme coins like Pepe Coin ($PEPE) and Janicetoken continue to attract speculative interest. While these assets lack intrinsic utility, their price movements are heavily influenced by community hype and social media trends. Investors should approach these assets with caution, as they are highly volatile and prone to sudden crashes.

2. Utility Tokens and Long-Term Potential

In contrast, utility tokens like Moonriver (MOVR) and FTT Coin offer more sustainable value propositions. MOVR, for instance, has faced significant year-to-date losses (-54.75%), but its role in the Polkadot ecosystem could position it for a rebound if the broader market recovers.

—

Market Dynamics and External Influences

1. The Role of the U.S. Dollar and Interest Rates

AstralX’s analysis highlights that a strong U.S. dollar and Federal Reserve policies are exerting downward pressure on Bitcoin and Ethereum. Former Federal Reserve officials have noted that Powell’s recent remarks suggest a cautious stance on interest rates, which could impact crypto markets in the short term.

2. Telegram Gift Index: A New Market Indicator

Unlike traditional trading metrics, the Telegram Gift Index—based on transaction data from key marketplaces—provides an alternative way to gauge market sentiment. This index could offer insights into emerging trends before they become mainstream.

—

Conclusion: Strategic Positioning in a Volatile Market

The cryptocurrency market in August 2025 presents both opportunities and challenges. Institutional adoption, altcoin trends, and Bitcoin’s volatility are key factors shaping the landscape. Investors should:

– Monitor institutional movements for long-term bullish signals.

– Exercise caution with meme coins, as they are highly speculative.

– Stay informed on macroeconomic factors, such as interest rates and dollar strength.

– Use technical and on-chain analysis to make data-driven decisions.

As the market evolves, adaptability and strategic positioning will be crucial for navigating the next phase of the crypto cycle.

—

Sources