Navigating the Cryptocurrency Market: A Deep Dive into Recent Trends and Insights

Introduction: The Volatile Nature of Cryptocurrency

The cryptocurrency market is renowned for its rapid and unpredictable price movements. Bitcoin (BTC), the flagship cryptocurrency, often sets the tone for the broader market, influencing altcoins and emerging digital assets. Recent data from Sentora, a leading DeFi analytics platform, suggests a potential Bitcoin price drop, sparking discussions among traders and analysts about the underlying causes and future implications.

This report explores the factors contributing to recent market fluctuations, analyzes key trends, and provides insights into whether the current dip is a correction or the beginning of a downtrend. Additionally, we examine trader sentiment, market signals, and strategic considerations for investors.

—

Why Is Crypto Dropping Today?

1. Market Correction or Downtrend?

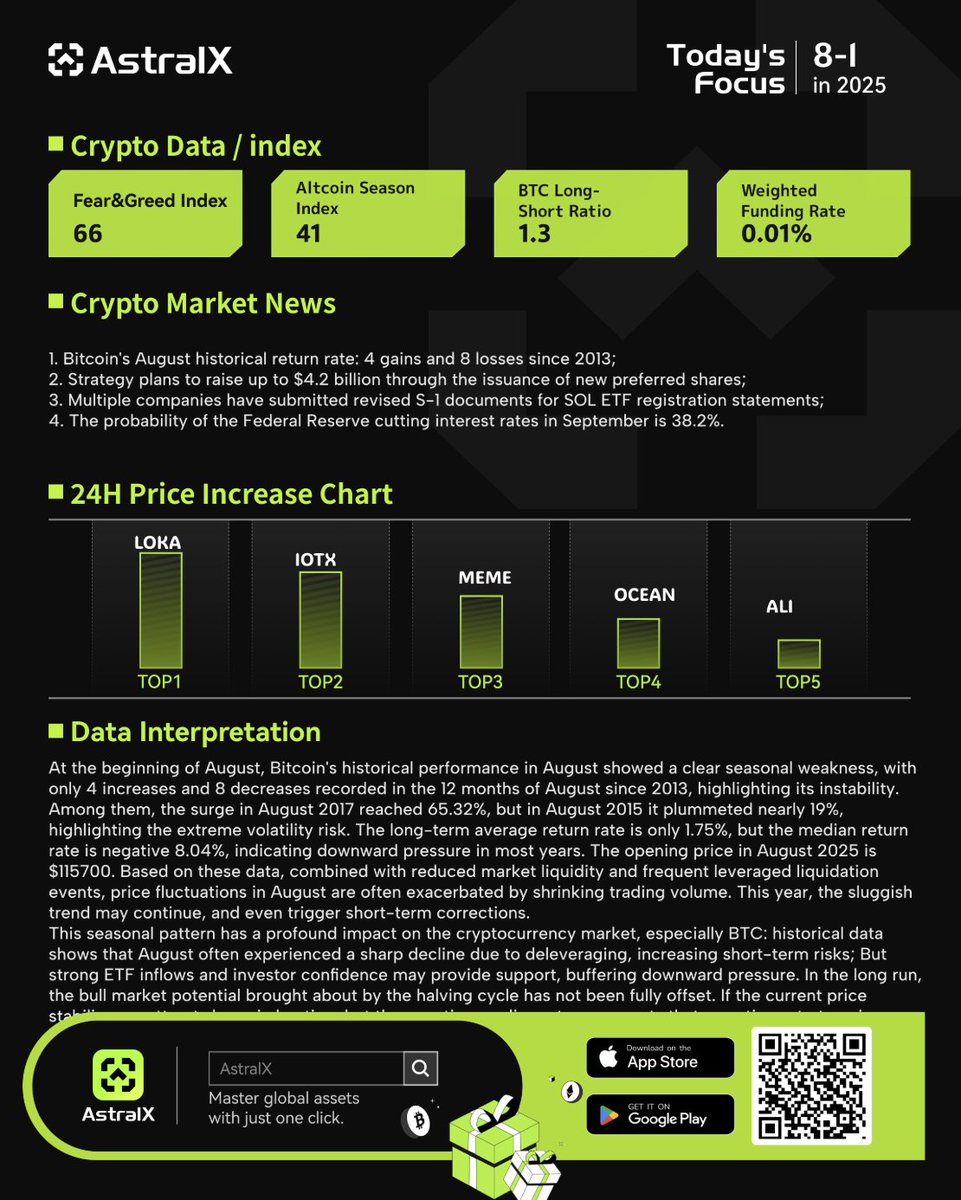

The cryptocurrency market has recently witnessed significant declines in Bitcoin and Ethereum (ETH), raising questions about whether this is a temporary correction or the start of a prolonged downtrend. Historical data shows that Bitcoin’s performance in August has been mixed, with four gains and eight losses since 2013. This suggests that while volatility is expected, the market’s direction remains uncertain.

2. Key Factors Shaking the Market

Several factors contribute to the current market downturn:

– Strengthening U.S. Dollar: A stronger dollar often leads to selling pressure on cryptocurrencies, as investors seek safer assets.

– Whale Movement: Large holders (whales) moving significant amounts of BTC and ETH can trigger market volatility.

– Regulatory Uncertainty: Ongoing regulatory discussions and potential policy changes can create market instability.

– Macroeconomic Conditions: Global economic trends, such as interest rate adjustments by the Federal Reserve, impact investor sentiment.

3. Trader Signals and Market Indicators

Technical analysis plays a crucial role in understanding market movements. For instance, Lista DAO (LISTA) has shown strong performance in the past 60 and 90 days, with gains of +41.05% and +62.63%, respectively. However, Bitcoin’s recent drop below $115,000 has raised concerns about short-term bearish momentum.

Traders are closely monitoring key indicators, such as:

– Moving Averages (MA): Short-term and long-term MAs can signal potential trend reversals.

– Relative Strength Index (RSI): Overbought or oversold conditions may indicate upcoming price corrections.

– On-Chain Data: Whale transactions and exchange inflows provide insights into institutional activity.

—

Buy Now or Wait?

1. Short-Term vs. Long-Term Strategies

Investors must decide whether to capitalize on the current dip or wait for further clarity. Short-term traders may look for buying opportunities during pullbacks, while long-term holders might see this as a chance to accumulate more BTC at lower prices.

2. Risk Management and Execution

A recent trader’s experience highlights the importance of execution over analysis. Even with a well-researched strategy, poor trade execution can lead to missed opportunities or unnecessary losses. Setting proper stop-loss and take-profit levels is essential for managing risk.

3. Emerging Opportunities in Altcoins

While Bitcoin dominates headlines, altcoins like Pepe Coin ($PEPE) and Virtuals Protocol (VIRTUALS) offer unique investment opportunities. Pepe Coin, inspired by the “Pepe the Frog” meme, has gained popularity due to its community-driven momentum. Virtuals Protocol, on the other hand, integrates AI with Metaverse technologies, presenting a high-growth potential niche.

—

Conclusion: Navigating the Crypto Landscape

The cryptocurrency market remains highly dynamic, with Bitcoin’s recent decline serving as a reminder of its inherent volatility. While short-term fluctuations are inevitable, long-term investors should focus on fundamental trends, regulatory developments, and technological advancements.

For traders, understanding market signals, managing risk, and executing trades effectively are crucial for success. Whether you choose to buy the dip or wait for further confirmation, staying informed and adaptable is key in this ever-evolving financial landscape.

—

Sources: