The Current State of Bitcoin: A Deep Dive into Market Trends and Innovations

Imagine a world where digital gold is not just a concept but a reality that shapes global finance. Bitcoin, the pioneer of cryptocurrencies, continues to captivate the imagination of investors, traders, and enthusiasts. As of April 15, 2025, Bitcoin is navigating through a series of technical and fundamental shifts that are shaping its future trajectory. Let’s dive into the current state of Bitcoin, exploring market trends, technical indicators, and innovative developments that are poised to influence its supply, demand, and overall market dynamics.

Market Trends and Technical Analysis

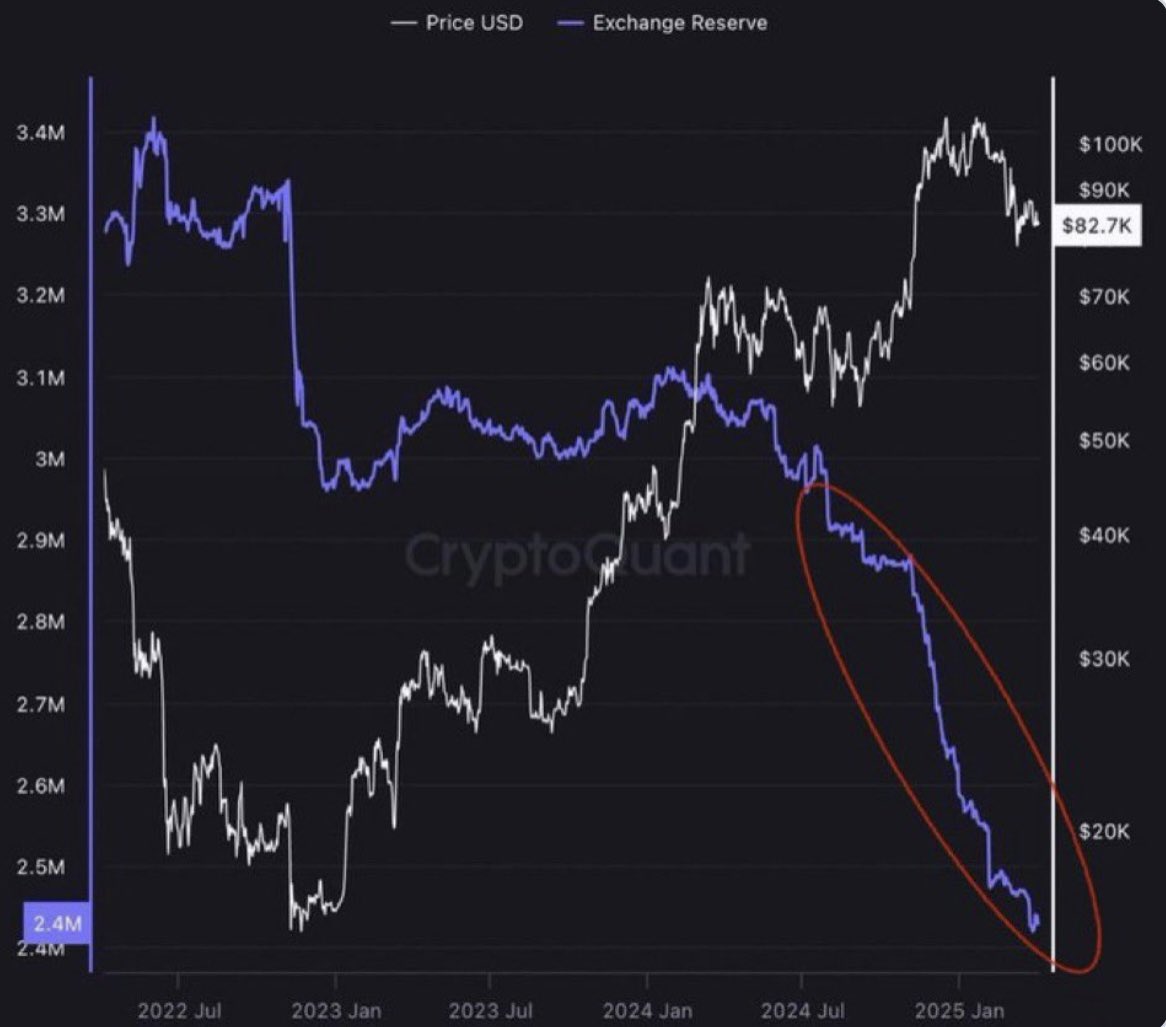

Supply Shock and Exchange Dynamics

One of the most intriguing developments in the Bitcoin market is the potential supply shock that exchanges are currently experiencing. As exchanges run out of Bitcoin supply, the dynamics of buying and selling are undergoing significant changes. This scarcity could lead to increased demand and potentially drive up the price of Bitcoin. The supply shock is a critical factor to watch, as it could signal a bullish reversal pattern in the near future. For instance, exchanges like Binance and Coinbase have reported dwindling reserves, which could create a supply crunch and push prices higher [1].

Key Support and Resistance Levels

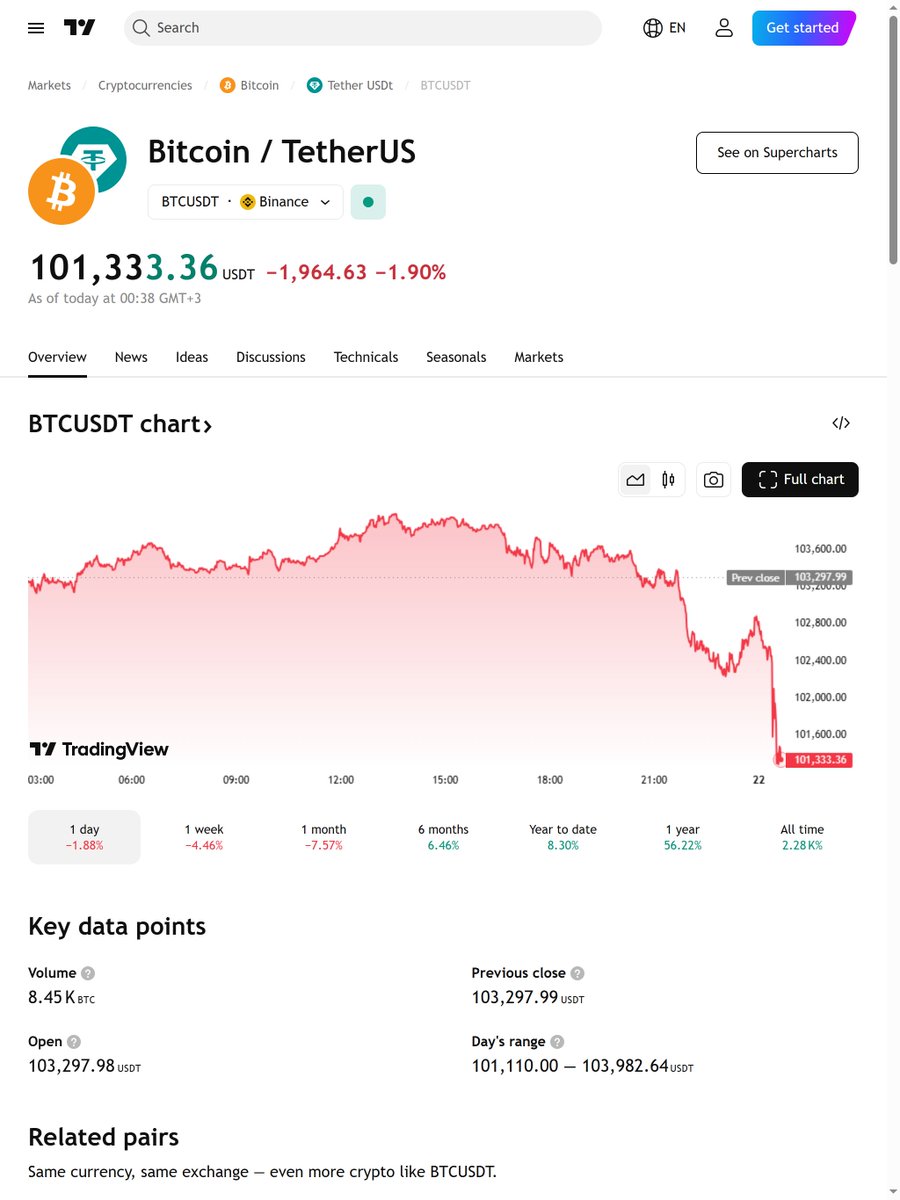

Technical analysis plays a crucial role in understanding the short-term and long-term movements of Bitcoin. As of April 15, 2025, Bitcoin is showing a critical support level at $92,810, with the Relative Strength Index (RSI) at 45, indicating potential for a bullish reversal pattern. Traders are closely monitoring this key level, as a break above it could signal a shift in market sentiment. Additionally, the 4-hour technical analysis highlights the importance of the 300 consolidated Moving Average (MA), which has failed to stay above multiple times, suggesting a downward trend until a solid close above $86,000 on the 4-hour chart [2].

Retail Trader Sentiment

Retail traders are becoming increasingly cautious about Bitcoin, as indicated by a low long percentage and order book friction. Key levels to watch include $85,000 as resistance and $76,000 as support. This cautious sentiment is reflected in the market’s consolidation near $84,000, with support at $83,000. The market is showing cautious bullish signs after breaking out of a falling wedge pattern and a multi-month downtrend, but it is essential not to confuse early momentum with a parabolic breakout just yet [3].

Innovations in Bitcoin’s Layer 2

Scalability and Decentralization

Layer 2 innovations are playing a pivotal role in enhancing Bitcoin’s scalability and decentralization. Projects like Solaxy and Truebit are driving significant advancements in these areas, promising more financial freedom and efficiency. These innovations are crucial for Bitcoin’s long-term sustainability and adoption, as they address some of the most pressing challenges facing the network. For example, the Lightning Network, a Layer 2 solution, allows for faster and cheaper transactions, making Bitcoin more viable for everyday use [4].

The Role of Vitalik Buterin

Vitalik Buterin, the co-founder of Ethereum, has shown interest in Bitcoin’s Layer 2 developments, highlighting the importance of these innovations in the broader cryptocurrency ecosystem. His involvement and curiosity underscore the potential impact of Layer 2 solutions on Bitcoin’s future. Buterin’s insights often influence the broader crypto community, and his endorsement of Bitcoin’s Layer 2 innovations could accelerate their adoption and development [5].

Conclusion: Navigating the Future of Bitcoin

As Bitcoin continues to evolve, it is essential to stay informed about the latest market trends, technical indicators, and innovative developments. The potential supply shock, key support and resistance levels, and Layer 2 innovations are all critical factors that will shape the future of Bitcoin. By understanding these dynamics, investors and traders can make more informed decisions and navigate the ever-changing landscape of the cryptocurrency market.

The future of Bitcoin is filled with both opportunities and challenges. As the market continues to evolve, it is crucial to remain vigilant and adaptable, leveraging the latest insights and innovations to stay ahead of the curve. The journey of Bitcoin is far from over, and the next few years promise to be as exciting and transformative as ever. Whether you are a seasoned investor or a curious newcomer, the world of Bitcoin offers a wealth of possibilities and a frontier of financial innovation.