The Cryptocurrency Landscape in 2025

Imagine a world where digital currencies are as common as fiat money. A world where Bitcoin and Ethereum are household names, and where the total market cap of cryptocurrencies is a topic of daily conversation. Welcome to 2025, where the cryptocurrency landscape is more dynamic and influential than ever before. Let’s dive into the current state of the market, the trends shaping its future, and the challenges it faces.

Market Sentiment and Institutional Adoption

Positive Sentiment Drives the Market

In 2025, market sentiment analysis reveals a bullish outlook, with institutional adoption leading the charge. Institutional investors are increasingly viewing cryptocurrencies as a legitimate asset class, driving positive sentiment. Bitcoin, in particular, is seen as a store of value, similar to gold, and is attracting significant interest from institutional investors. This institutional adoption is a major factor in the current positive market sentiment, with a sentiment score of +0.80 for institutional adoption and +0.65 for Bitcoin[1].

Institutional investors bring not only capital but also credibility to the market. Their involvement signals a level of trust and stability that was previously lacking. This shift is evident in the growing number of hedge funds, pension funds, and even traditional banks that are now allocating a portion of their portfolios to cryptocurrencies. The influx of institutional money has also led to the development of more sophisticated trading tools and platforms, making it easier for these large investors to enter and navigate the market.

Regulatory Concerns and Bearish Outlook

Despite the positive sentiment, regulatory concerns are casting a shadow over the market. The lack of clear regulatory frameworks in many jurisdictions is creating uncertainty and bearish sentiment. Regulatory concerns have a sentiment score of -0.45, indicating a significant bearish outlook. However, the smart money is moving in, suggesting that institutional investors are willing to navigate these regulatory headwinds[1].

Regulatory uncertainty is a double-edged sword. On one hand, it can deter some investors who prefer a more stable and predictable environment. On the other hand, it can also create opportunities for those who are willing to take on the risk. The key for regulators is to strike a balance between protecting investors and fostering innovation. This means creating clear guidelines that provide a level of security without stifling the growth and development of the cryptocurrency market.

Policy Shifts and Government Integration

Strategic Bitcoin Reserve and Regulatory Clarity

Significant policy shifts toward crypto-integration in US governance are underway. The Trump administration’s cryptocurrency policies include a strategic Bitcoin reserve and efforts to provide regulatory clarity. These policy shifts are aimed at integrating cryptocurrencies into the mainstream financial system, providing a more stable environment for investors and businesses[2].

The idea of a strategic Bitcoin reserve is particularly intriguing. By holding a reserve of Bitcoin, the government can stabilize the market and provide a benchmark for the value of the cryptocurrency. This can also help to legitimize Bitcoin as a store of value, further driving its adoption and acceptance. Regulatory clarity, on the other hand, can provide a framework for businesses and investors to operate within, reducing the uncertainty and risk associated with the market.

The Role of Government in Cryptocurrency Adoption

Government integration of cryptocurrencies is a double-edged sword. On one hand, it provides legitimacy and stability to the market. On the other hand, it raises concerns about government control and surveillance. The balance between regulation and innovation will be crucial in shaping the future of the cryptocurrency market.

Governments around the world are grappling with how to regulate cryptocurrencies. Some, like Japan and Switzerland, have taken a more proactive approach, creating clear guidelines and frameworks for the market. Others, like the United States, are still in the process of developing their policies. The key for governments is to find a balance between protecting investors and fostering innovation. This means creating regulations that provide a level of security without stifling the growth and development of the cryptocurrency market.

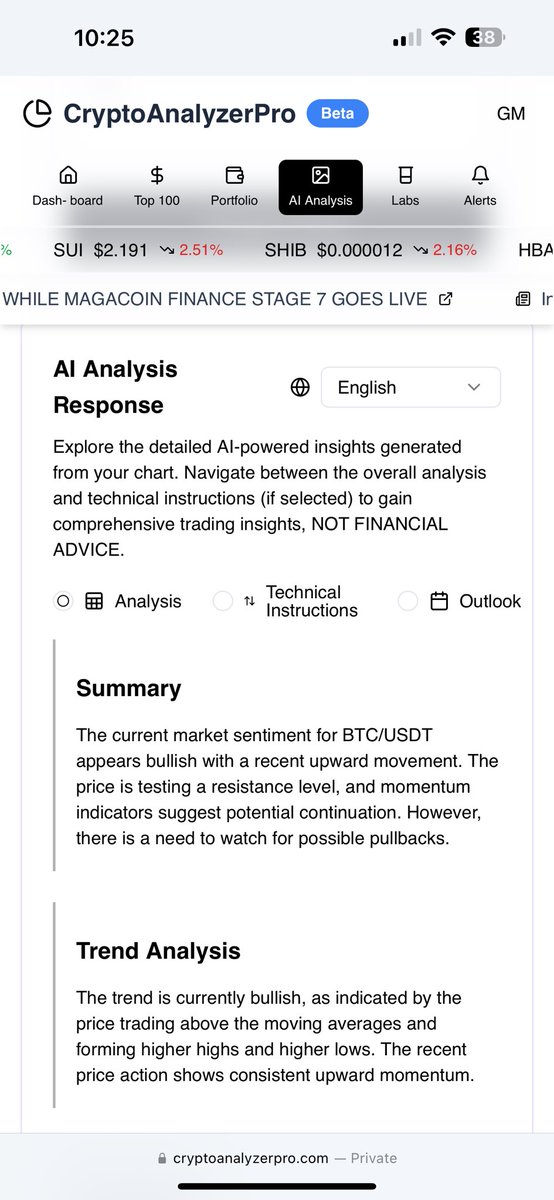

Technical Analysis and Market Trends

Total Market Cap Analysis

The total cryptocurrency market cap is currently consolidating within a descending channel. This consolidation is facing rejection from the resistance trendline of the channel, with the Ichimoku Cloud acting as a strong resistance barrier. This technical analysis suggests a period of consolidation before the next significant move[3].

Consolidation periods are a normal part of any market cycle. They provide a time for the market to digest recent gains and for investors to reassess their positions. The current consolidation in the cryptocurrency market is no different. The key for investors is to be patient and to look for signs of a potential breakout. This could come in the form of a break above the resistance trendline or a move above the Ichimoku Cloud.

Bitcoin and Ethereum Recovery Signals

Bitcoin and Ethereum are showing signs of recovery after recent corrections. Bitcoin is consolidating between $76K and $85K, with the Relative Strength Index (RSI) turning bullish and increasing volume. The key resistance level at $85K could trigger the next leg up. Ethereum, on the other hand, is stabilizing between $1,450 and $1,650, with the RSI bouncing from oversold territory. The key level to watch for Ethereum is $1,700[4,5].

The recovery in Bitcoin and Ethereum is a positive sign for the market. These two cryptocurrencies are the largest and most influential in the market, and their performance often sets the tone for the rest of the market. The key for investors is to watch these levels closely and to be ready to act when they are breached. A break above $85K for Bitcoin or $1,700 for Ethereum could signal the start of a new bull run.

Challenges and Risks

Rug-Pull Patterns and Market Manipulation

The cryptocurrency market is not without its risks. Analysis reveals potential rug-pull patterns in some crypto projects, where insiders dump holdings at the expense of Initial Coin Offering (ICO) participants. These rug-pull patterns highlight the need for vigilance and due diligence in the cryptocurrency market[6].

Rug-pull patterns are a form of market manipulation where insiders or developers of a crypto project dump their holdings, causing the price to crash and leaving other investors with worthless tokens. These patterns are often seen in ICOs, where the hype and excitement can lead to irrational investing. The key for investors is to be vigilant and to do their own research before investing in any crypto project.

Impulsive Moves and Market Volatility

Impulsive moves in cryptocurrency futures trading refer to sudden and significant price movements driven by market sentiment, news, or other factors. These impulsive moves can lead to high volatility and market manipulation, making it challenging for investors to navigate the market[7].

Impulsive moves are a common feature of the cryptocurrency market. They can be driven by a variety of factors, including news events, regulatory changes, or even social media trends. The key for investors is to be prepared for these moves and to have a plan in place to manage the risk. This could include setting stop-loss orders, diversifying their portfolio, or even taking a step back from the market during periods of high volatility.

The Future of Cryptocurrency

AI and Decentralized Networks

The future of cryptocurrency lies in the integration of artificial intelligence and decentralized networks. Projects like AlloraNetwork are taking AI to the next level by connecting AI models to provide accurate and fast predictions for decentralized finance (DeFi), cryptocurrency prices, and complex data analysis. These advancements will enhance the efficiency and accuracy of the cryptocurrency market, making it more accessible and reliable for investors[8].

AI and decentralized networks have the potential to revolutionize the cryptocurrency market. AI can provide more accurate and faster predictions, helping investors to make better decisions. Decentralized networks, on the other hand, can provide a more secure and transparent environment for trading and investing. The key for the market is to embrace these technologies and to integrate them into the existing infrastructure.

The Role of Innovation and Regulation

Innovation and regulation will play a crucial role in shaping the future of the cryptocurrency market. While innovation drives the market forward, regulation provides the necessary stability and security. The balance between the two will determine the success and sustainability of the cryptocurrency market.

Innovation is the lifeblood of the cryptocurrency market. It drives the development of new technologies, new use cases, and new opportunities. However, innovation must be balanced with regulation to ensure the market’s stability and security. This means creating regulations that provide a level of security without stifling the growth and development of the cryptocurrency market.

Conclusion

Embracing the Future

The cryptocurrency landscape in 2025 is a testament to the power of innovation and the resilience of the market. Despite the challenges and risks, the market continues to evolve and grow, driven by positive sentiment, institutional adoption, and technological advancements. As we embrace the future, it is essential to stay informed, vigilant, and adaptable. The cryptocurrency market is not just a financial revolution; it is a societal shift towards a more decentralized and inclusive financial system. The future is here, and it is digital.

The cryptocurrency market is still in its early stages, and there is much work to be done. However, the progress made so far is a testament to the potential of this market. As we look to the future, it is essential to embrace the opportunities and challenges that come with it. This means staying informed, being vigilant, and being adaptable. The cryptocurrency market is not just a financial revolution; it is a societal shift towards a more decentralized and inclusive financial system. The future is here, and it is digital.

References

[1] Cryptocurrency Market Sentiment

[2] Policy Shifts and Government Integration

[7] Impulsive Moves