Introduction

Imagine navigating a bustling marketplace where fortunes can be made or lost in the blink of an eye. Welcome to the world of cryptocurrency, a realm of digital gold, decentralized finance, and boundless potential. In this dynamic landscape, staying informed is not just an advantage; it’s a necessity. Let’s dive into the latest trends and analyses from the crypto community, focusing on Bitcoin and other key players, to uncover opportunities and challenges that lie ahead.

Bitcoin’s Performance and Market Dynamics

Weekly Performance Overview

Bitcoin, the pioneer of cryptocurrencies, has once again demonstrated its resilience and growth potential. From April 7 to April 13, 2025, Bitcoin opened at $78,370.15 and closed at $83,733.07, marking a significant weekly change of +6.84%[1]. This upward trajectory was characterized by a break above key resistance levels, with a weekly high of $86,092.99 and a low of $74,420.69. The Point of Control (POC) for the week was $79,050.70, indicating a strong area of price acceptance[1].

Technical Analysis and Price Action

Bitcoin’s price action has reached a critical juncture, testing the top of a short-term descending channel and a strong supply zone[2]. Despite this, buy pressure remains robust, suggesting potential for further upward movement. Traders are advised to monitor these levels closely, as a breakout or reversal could signal significant market shifts[2]. The technical indicators, such as moving averages and relative strength index (RSI), are aligning to support a bullish outlook, but caution is advised as market sentiment can change rapidly.

Market Dominance and Sentiment

As of April 14, 2025, Bitcoin’s market dominance stands at 62.65%, reflecting its continued influence in the crypto market[3]. The Fear and Greed Index is at 29, indicating a state of fear among investors. This sentiment can often present buying opportunities for those with a contrarian outlook[3]. The market’s fear can be a double-edged sword; while it may signal a potential correction, it also creates a fertile ground for savvy investors to accumulate assets at discounted prices.

Ethereum and Altcoins: Opportunities and Challenges

Ethereum’s Potential Breakout

Ethereum, the second-largest cryptocurrency by market capitalization, is also primed for a potential breakout. With a price of $1,643 as of April 14, 2025, Ethereum is poised to capitalize on the growing interest in digital ownership, NFTs, and gaming[4]. The “digital gold” narrative for Bitcoin is stronger than ever, but Ethereum’s utility in decentralized applications (dApps) and smart contracts cannot be overlooked[4]. Ethereum’s upcoming upgrades, such as the transition to Ethereum 2.0, aim to improve scalability and security, making it an attractive option for developers and investors alike.

Altcoins and the Broader Market

The total crypto market cap stands at $2.68 trillion, with Bitcoin and Ethereum leading the charge[3]. However, altcoins also present unique opportunities and challenges. For instance, Kaspa ($KAS) and other emerging projects are gaining attention for their innovative approaches to security and scalability[5]. Altcoins often offer higher volatility and potential returns, but they also come with increased risk. Traders and investors should stay informed about these developments to identify potential breakout candidates and manage risk effectively.

Trading Strategies and Insights

Premium Trading Lessons and Signals

For those looking to gain an edge in the crypto market, accessing premium trading lessons and accurate signals can be invaluable. Platforms and experts offering real-time market analysis and updates can help traders make informed decisions[6]. Joining communities and following experienced traders can provide insights that are not readily available to the general public. These resources can help traders understand complex market dynamics, identify trends, and execute trades with greater precision.

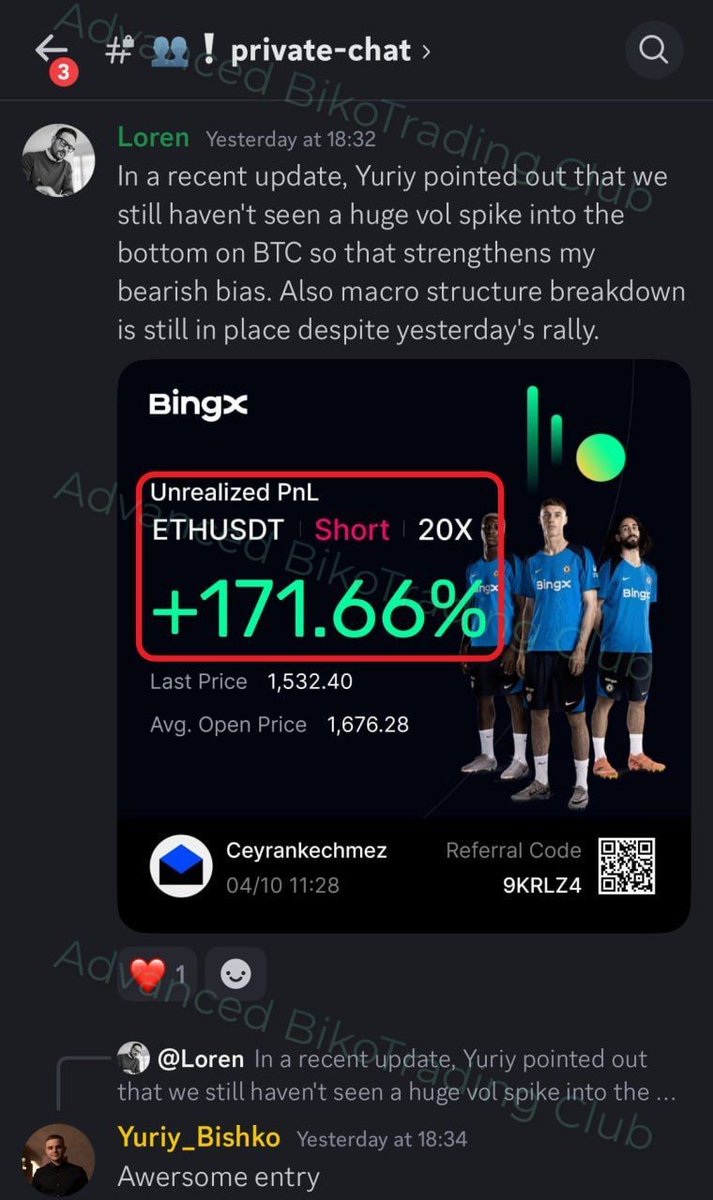

Macro Insights and Trading Opportunities

Macroeconomic chaos often translates to crypto opportunities. As traditional markets experience volatility, investors turn to cryptocurrencies as a hedge against inflation and economic uncertainty. Understanding these macro trends can help traders position themselves for potential gains[4]. For example, the ongoing geopolitical tensions and economic policies can drive demand for digital assets, presenting lucrative trading opportunities. By staying informed about global economic trends, traders can anticipate market movements and capitalize on emerging opportunities.

Conclusion: Navigating the Crypto Landscape

The Path Forward

The crypto landscape is ever-evolving, with new opportunities and challenges emerging daily. Whether you’re focusing on Bitcoin, Ethereum, or altcoins, staying informed and adaptable is key to success. By leveraging premium trading lessons, real-time market analysis, and a deep understanding of macroeconomic trends, traders can navigate the crypto landscape with confidence.

As we move forward, it’s essential to remain vigilant and open to new information. The crypto community is a treasure trove of insights and opportunities, and by engaging with it, traders can stay ahead of the curve. So, whether you’re a seasoned trader or a curious newcomer, embrace the journey and keep exploring the exciting world of cryptocurrency. The future of finance is digital, and those who adapt and innovate will reap the rewards.