The Power of Market Sentiment in Predictive Analysis

Understanding Market Sentiment

Imagine a bustling marketplace where traders shout prices, buyers haggle, and sellers boast about their wares. The energy in the room, the collective mood, can tell you a lot about what’s happening and what might happen next. This is the essence of market sentiment—an intangible yet powerful force that can drive market movements. Market sentiment refers to the overall attitude of investors toward a particular market, sector, or asset. It’s the collective mood that can sway prices up or down, often before any fundamental changes occur.

The Psychology Behind Market Sentiment

At its core, market sentiment is driven by human psychology. Two primary emotions dominate this landscape: fear and greed. When fear grips the market, investors tend to sell off assets, leading to a decline in prices. This is often seen during economic downturns or geopolitical crises. Conversely, when greed takes over, investors buy aggressively, driving prices up. This emotional tug-of-war creates the volatility we see in financial markets.

Understanding these emotional drivers is crucial. For instance, during the 2008 financial crisis, fear led to a massive sell-off, causing prices to plummet. Conversely, the dot-com boom of the late 1990s was fueled by greed, with investors pouring money into tech stocks, driving prices to unsustainable heights.

Tools and Techniques for Sentiment Analysis

Sentiment analysis involves using various tools and techniques to gauge the market’s mood. These can range from simple surveys and polls to sophisticated algorithms that analyze social media posts, news articles, and other forms of communication. Natural Language Processing (NLP) is a key technology in this field, enabling machines to understand and interpret human language. By analyzing the tone and content of communications, NLP can provide valuable insights into market sentiment.

For example, sentiment analysis tools can scan news articles for positive or negative language about a particular stock. If the sentiment is overwhelmingly positive, it might indicate a potential price increase. Conversely, negative sentiment could signal a drop in prices.

Applying Sentiment Analysis to Market Predictions

Once market sentiment is understood, it can be applied to make predictions about future market movements. This involves a combination of quantitative and qualitative analysis. Quantitative methods use statistical models to identify patterns and trends in sentiment data. Qualitative methods, on the other hand, involve interpreting the context and nuances of communications to gain deeper insights.

Predicting Market Fluctuations

Market fluctuations are often driven by shifts in sentiment. For example, a sudden surge in negative sentiment on social media about a particular stock can indicate an impending sell-off. Conversely, positive sentiment can signal a potential rally. By monitoring sentiment in real-time, investors can anticipate these fluctuations and adjust their portfolios accordingly. This proactive approach can help mitigate risks and capitalize on opportunities.

The Role of Social Media

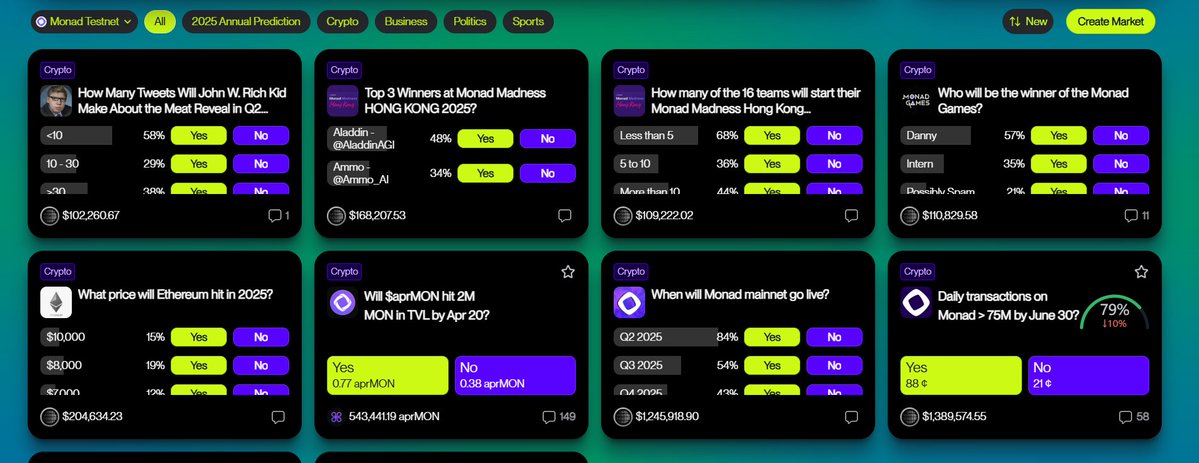

Social media has become a powerful tool for sentiment analysis. Platforms like Twitter, Reddit, and Facebook provide a wealth of data on investor sentiment. By analyzing the tone and content of posts, investors can gain insights into the collective mood of the market. For instance, a tweet from a prominent investor or a viral post on Reddit can significantly impact market sentiment and, consequently, prices. Tools like sentiment analysis dashboards can help investors track these trends in real-time.

For example, during the GameStop saga in early 2021, social media played a pivotal role. Retail investors on platforms like Reddit’s WallStreetBets forum drove up the stock price through collective buying, defying traditional market sentiment analysis tools. This event highlighted the power of social media in shaping market sentiment and the need for real-time monitoring.

Case Studies and Real-World Applications

To illustrate the power of sentiment analysis, let’s look at a few real-world examples.

The Rollercoaster Ride of Solana

Solana, a popular blockchain platform, has experienced significant volatility in recent years. Analyzing sentiment around Solana can provide insights into its price movements. For example, during periods of high positive sentiment, such as when new partnerships or technological advancements are announced, Solana’s price tends to rise. Conversely, negative sentiment, such as reports of technical issues or regulatory concerns, can lead to a decline in price. By monitoring sentiment, investors can make more informed decisions about when to buy or sell Solana.

The KiX Sports NFT Exchange

KiX Sports NFT Exchange has seen its share of ups and downs. The performance of athletes like Kvara, who recently hit the top spot on the KiX Performance Podium, can significantly impact the sentiment around KiX tokens. Positive performance and achievements can boost sentiment, leading to increased demand and higher prices. Conversely, poor performance can dampen sentiment and lead to a sell-off. By analyzing sentiment around KiX Sports NFT Exchange, investors can anticipate these trends and adjust their strategies accordingly.

The Future of Sentiment Analysis

As technology continues to evolve, the field of sentiment analysis is poised for significant advancements. Machine learning and artificial intelligence will play a crucial role in enhancing the accuracy and efficiency of sentiment analysis. These technologies can process vast amounts of data in real-time, providing investors with up-to-the-minute insights into market sentiment.

Ethical Considerations

While sentiment analysis offers tremendous potential, it also raises ethical considerations. The use of personal data and the potential for manipulation are key concerns. It is essential to ensure that sentiment analysis is conducted ethically, with a focus on transparency and privacy. Investors and analysts must be mindful of these ethical considerations and strive to use sentiment analysis responsibly.

Conclusion: Navigating the Market with Sentiment Analysis

In conclusion, market sentiment analysis is a powerful tool for predicting market fluctuations and making informed investment decisions. By understanding the psychology behind market sentiment and leveraging advanced tools and techniques, investors can gain valuable insights into the collective mood of the market. Whether it’s analyzing social media trends or monitoring real-time data, sentiment analysis provides a proactive approach to navigating the complexities of financial markets. As we look to the future, the continued evolution of sentiment analysis promises even greater opportunities for investors to stay ahead of the curve and make smarter, more informed decisions.

Embracing the Power of Sentiment

The power of sentiment analysis lies in its ability to provide a window into the collective psyche of the market. By embracing this tool, investors can gain a competitive edge and navigate the tumultuous seas of financial markets with greater confidence and precision. So, the next time you stand at the edge of the market, remember that the waves of sentiment can be your guide, helping you ride the crests and avoid the troughs.