Decoding the Future: Tokenized Real Estate, AI, and Blockchain

The Dawn of a New Investment Paradigm

Imagine standing in the heart of Tokyo, sipping coffee in a café you partially own, or watching the sun set over a vineyard in Napa Valley that you’ve invested in—all without ever leaving your home. This isn’t a distant dream but a rapidly approaching reality, thanks to the convergence of tokenized real estate, artificial intelligence (AI), and blockchain technology. These innovations are dismantling traditional barriers in property investment, making it more accessible, transparent, and efficient than ever before.

Tokenized Real Estate: Breaking Down Barriers

Accessibility and Affordability

Traditional real estate investment has long been a privilege of the wealthy, requiring substantial capital, complex legal processes, and significant time commitments. Tokenization is changing this by converting physical property into digital tokens on a blockchain. These tokens represent fractional ownership, allowing investors to buy a piece of a property for a fraction of the cost of full ownership [4, 6].

For example, instead of needing $500,000 to buy a luxury apartment in Paris, you could invest $5,000 for a small fraction of the same property. This democratization of investment opens the door to a broader range of investors, from retail buyers to institutional players.

Increased Liquidity

One of the biggest challenges in traditional real estate is liquidity. Selling a property can take months, if not years, due to market conditions, legal processes, and buyer availability. Tokenized real estate addresses this by allowing tokens to be traded on digital exchanges, much like stocks or cryptocurrencies. This means you can sell your stake in a property almost instantly, providing a level of liquidity previously unheard of in the real estate market [6].

Transparency and Security

Blockchain technology ensures that all transactions are recorded on an immutable ledger, providing a transparent and secure way to track ownership and transfers. This reduces the risk of fraud and disputes, as every transaction is verifiable and tamper-proof. Investors can trust that their ownership rights are protected and easily verifiable at any time.

AI: The Intelligent Backbone of Real Estate

AI is revolutionizing the real estate industry by providing data-driven insights that were previously unavailable. When combined with tokenized real estate, AI can help investors make smarter, more informed decisions.

Predictive Analytics

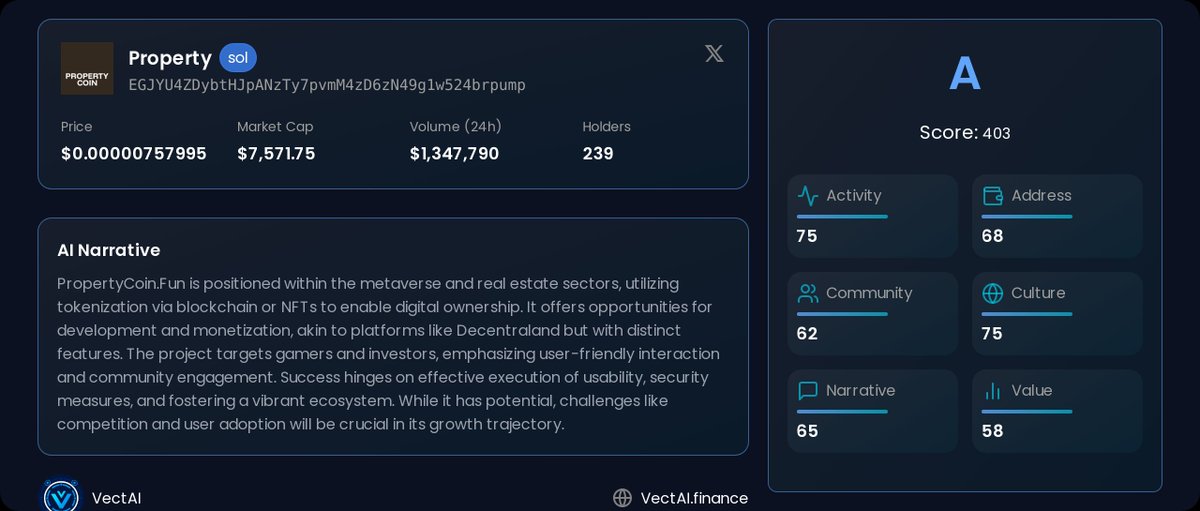

AI algorithms can analyze vast amounts of data, including market trends, economic indicators, and property-specific data, to predict future price movements and identify promising investment opportunities. Platforms like Token Metrics use AI to provide trading and research data, which can be adapted to analyze tokenized real estate investments [3].

For instance, AI can predict which neighborhoods are likely to see price appreciation based on factors like infrastructure development, population growth, and economic activity. This allows investors to make proactive decisions rather than reacting to market changes.

Automated Valuation

Traditional property valuation often involves costly appraisals and lengthy processes. AI can automate this by analyzing data from comparable properties, market trends, and other relevant factors to provide accurate and up-to-date valuations. This not only reduces costs but also speeds up the investment process.

Risk Management

Investing in real estate always comes with risks, from market volatility to regulatory changes. AI can assess these risks by analyzing historical data, market conditions, and other variables to provide a comprehensive risk profile for each investment. This helps investors make more informed decisions and manage their portfolios effectively.

Blockchain: The Foundation of Trust and Efficiency

Blockchain technology is the backbone of tokenized real estate, providing a secure, transparent, and efficient platform for managing ownership and transactions.

Immutable Record

Blockchain creates an immutable record of all transactions, ensuring that ownership is easily verifiable and cannot be altered. This reduces the risk of fraud and disputes, as every transaction is permanently recorded on the blockchain.

Smart Contracts

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They automate many of the processes involved in real estate transactions, such as rent collection, distribution of profits, and transfer of ownership. This streamlines operations, reduces administrative costs, and eliminates the need for intermediaries like banks and title companies [6].

Decentralization

Blockchain’s decentralized nature means that transactions are verified and recorded by a network of computers rather than a central authority. This reduces the risk of manipulation and increases the efficiency of transactions. It also eliminates the need for intermediaries, further reducing costs and increasing transparency.

Challenges and Opportunities

While the convergence of tokenized real estate, AI, and blockchain holds immense promise, several challenges must be addressed for widespread adoption.

Regulatory Uncertainty

The regulatory landscape for tokenized real estate is still evolving, and there is a need for clear and consistent regulations to provide legal certainty and protect investors. Governments and regulatory bodies are still grappling with how to classify and regulate tokenized assets, which can create uncertainty for investors.

Market Volatility

The value of tokenized real estate can be volatile, influenced by factors such as market sentiment, regulatory changes, and technological advancements. Investors need to be aware of these risks and invest accordingly, diversifying their portfolios to mitigate potential losses.

Technological Adoption

Widespread adoption of tokenized real estate requires greater awareness and understanding of the underlying technology. Education and outreach are essential to encourage participation, as many potential investors may be unfamiliar with blockchain and tokenization.

Despite these challenges, the opportunities presented by tokenized real estate, AI, and blockchain are vast. As the technology matures and regulatory frameworks become clearer, we can expect to see greater adoption of tokenized real estate, transforming the way we invest in and own property.

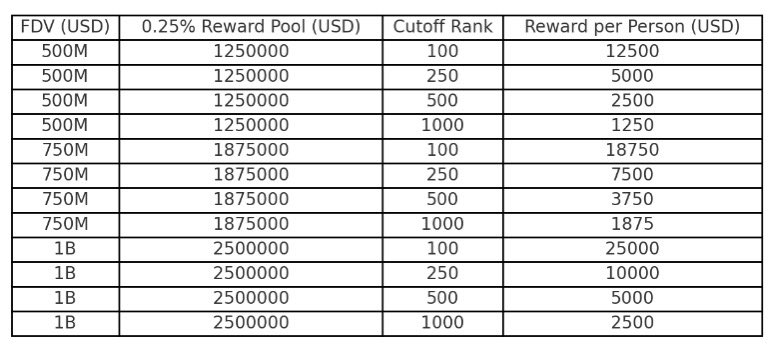

The ROI Calculator: A Glimpse into the Future

Tools like the Tokenized Real Estate ROI Calculator exemplify the practical applications of these technologies. Such calculators allow investors to analyze potential returns, rental yields, and overall profitability of blockchain-based real estate investments [1]. These tools empower individuals to make data-driven decisions, further democratizing the real estate investment landscape.

For example, an investor can input the purchase price of a tokenized property, expected rental income, and market conditions to calculate the potential return on investment. This transparency and accessibility make it easier for investors to evaluate opportunities and make informed decisions.

A New Era of Property Ownership

The fusion of tokenized real estate, AI, and blockchain is ushering in a new era of property ownership. By lowering barriers to entry, increasing liquidity, and enhancing transparency, these technologies are democratizing real estate investment and empowering individuals to participate in a market that was once reserved for the wealthy elite.

As these technologies continue to evolve, we can expect to see even greater innovation and disruption in the real estate industry. The future of property ownership is here, and it’s tokenized, intelligent, and decentralized. The question is no longer whether these technologies will transform the real estate market, but how quickly and comprehensively they will do so.

Sources: