Cryptocurrency Market Analysis: Key Trends and Insights (August 2025)

Introduction: A Volatile Yet Opportunistic Market

The cryptocurrency market remains one of the most dynamic and unpredictable financial landscapes, where rapid price swings, regulatory shifts, and technological advancements shape investor sentiment. As of August 2025, Bitcoin (BTC) has seen fluctuations below the $115,000 mark, while Ethereum (ETH) has rebounded near its March 2024 high of $3,980. Meanwhile, altcoins and emerging projects like Virtuals Protocol (VIRTUALS) and Lista DAO (LISTA) continue to attract attention with innovative use cases.

This report provides an in-depth analysis of recent market trends, key developments, and strategic insights for investors and traders.

—

Bitcoin’s Historical Performance in August

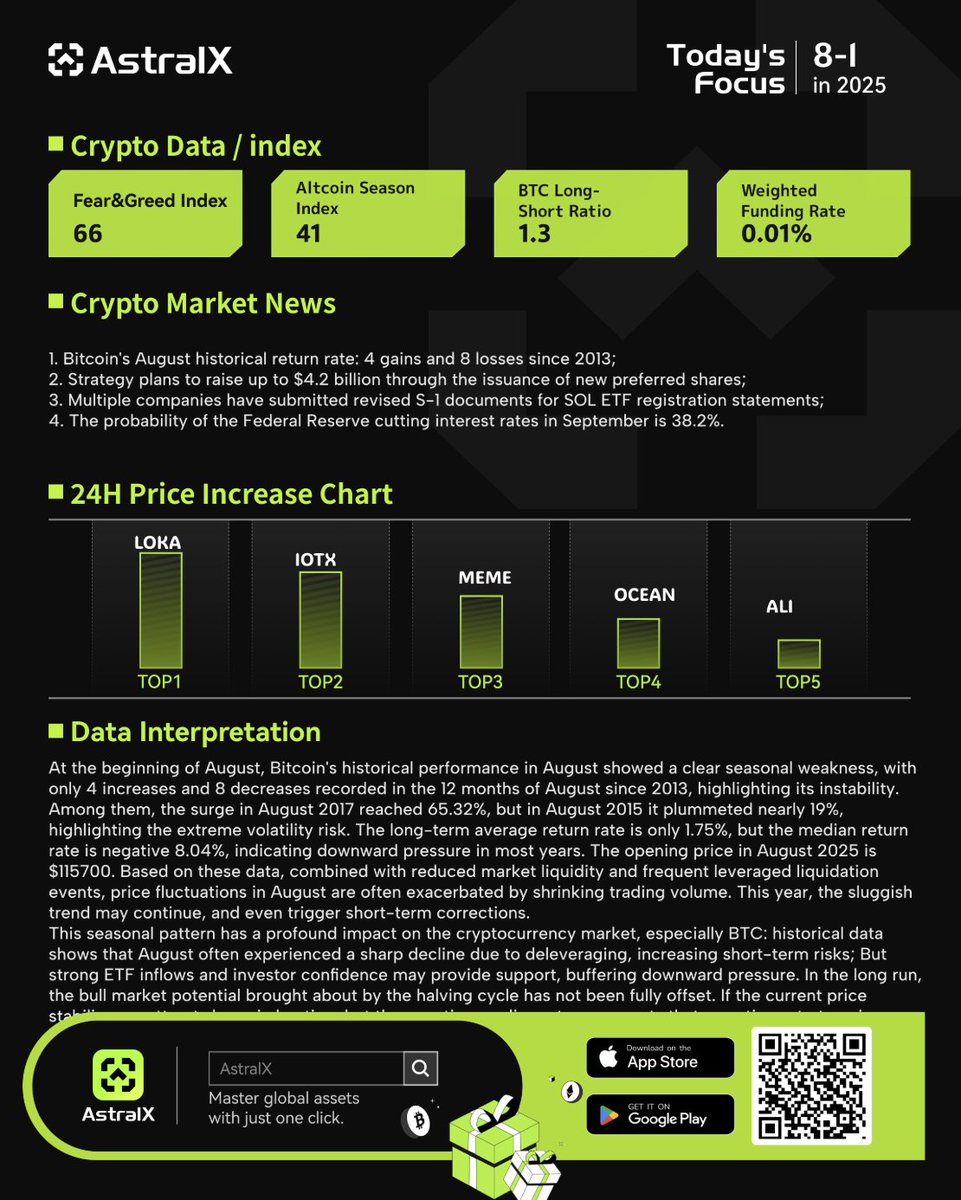

Bitcoin’s price movements in August have historically been mixed, with a record of 4 gains and 8 losses since 2013 [1]. This volatility underscores the importance of strategic planning and risk management for investors.

– Recent Downturn: Bitcoin recently dipped below $115,000, raising concerns about short-term bearish momentum.

– Long-Term Outlook: Despite fluctuations, Bitcoin remains a dominant force in the crypto market, with institutional interest and adoption continuing to grow.

—

Ethereum’s Resurgence and Altcoin Activity

Ethereum (ETH) has shown resilience, climbing back to near its March 2024 high of $3,980 [2]. This rebound suggests renewed confidence in the Ethereum ecosystem, particularly with the increasing adoption of decentralized finance (DeFi) and non-fungible tokens (NFTs).

– Altcoin Surge: Trading activity in altcoins has increased, with projects like Lista DAO (LISTA) and Polymesh (POLYX) experiencing significant price movements.

– LISTA/USDT: Up 41.05% in 60 days and 62.63% in 90 days [3].

– POLYX/USDT: Despite a YTD decline of 47.02%, it has shown a positive trend over the past 60 days [4].

—

Federal Reserve’s Impact on Crypto Markets

The Federal Reserve’s decision to keep interest rates unchanged for the fifth consecutive time has influenced market sentiment [5]. While this stability has provided some relief, investors remain cautious about potential future rate hikes.

– Market Reaction: Bitcoin and altcoins have exhibited mixed reactions, with some traders adopting a wait-and-see approach.

– Strategic Implications: Investors should monitor macroeconomic indicators, as central bank policies continue to impact crypto valuations.

—

Emerging Trends and Investment Opportunities

1. AI and Metaverse Integration

Virtuals Protocol (VIRTUALS) is gaining traction by combining artificial intelligence (AI) with Metaverse technologies [6]. This fusion presents new opportunities for decentralized applications (dApps) and immersive digital experiences.

2. Arbitrage and Treasury Programs

The $VAPE project has launched the world’s largest BNB treasury program, creating structured arbitrage opportunities [7]. Such initiatives highlight the growing sophistication of crypto trading strategies.

3. Trading Tools and Automation

The demand for automated trading tools continues to rise, with platforms offering real-time market insights and execution efficiency [8]. This trend is crucial for both retail and institutional traders.

—

Risks and Challenges

Despite the optimism, the crypto market faces several challenges:

– Regulatory Uncertainty: Governments worldwide are tightening regulations, which could impact market liquidity and adoption.

– Volatility Risks: Sudden price swings remain a concern, as seen in Bitcoin’s recent dip below $115,000.

– Execution Errors: A trader’s experience highlights the importance of proper order execution over analysis [9].

—

Conclusion: Navigating the Crypto Landscape

The cryptocurrency market in August 2025 presents a mix of opportunities and risks. While Bitcoin and Ethereum show resilience, altcoins and emerging projects like Virtuals Protocol and Lista DAO offer high-growth potential. Investors must stay informed about macroeconomic trends, regulatory developments, and technological advancements to make informed decisions.

As the market evolves, strategic planning, risk management, and continuous learning will be key to navigating this dynamic financial landscape.

—

References