The JPMorgan-Coinbase Partnership: A New Era of Crypto Accessibility

Introduction

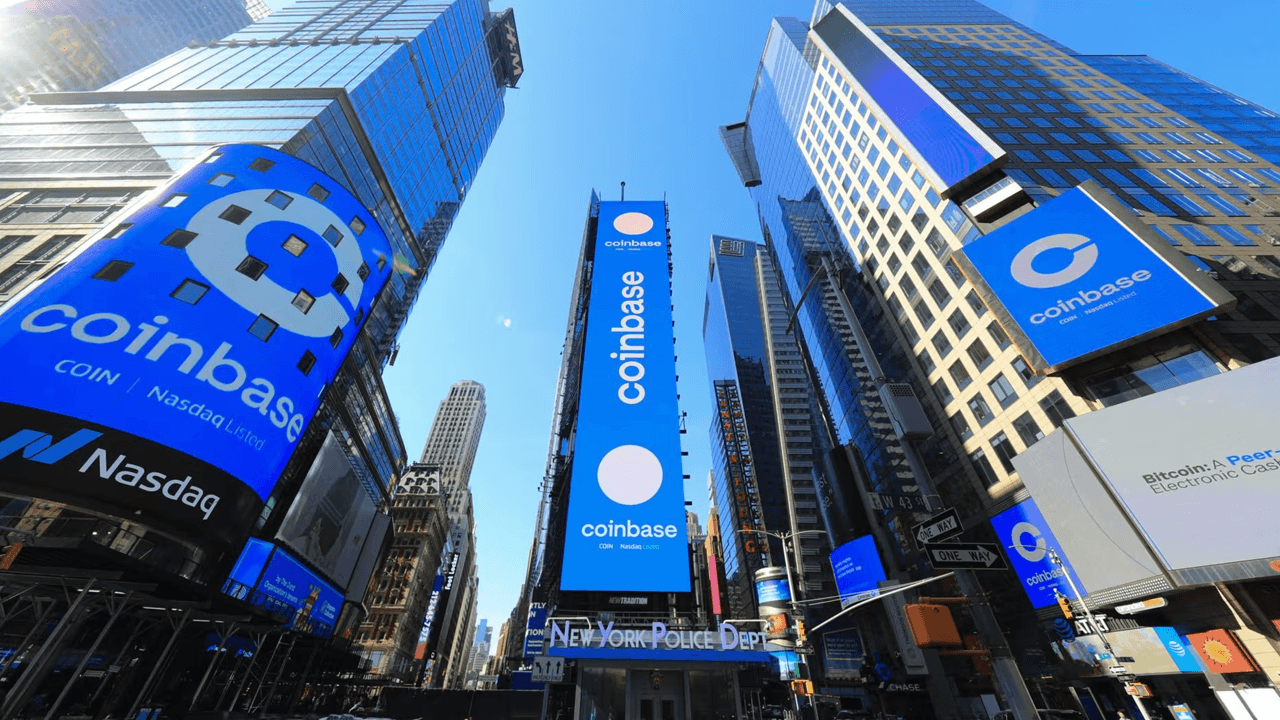

The financial industry is witnessing a profound transformation, driven by the increasing acceptance of cryptocurrencies. At the forefront of this evolution are traditional financial powerhouses like JPMorgan Chase, which are strategically collaborating with crypto-native platforms such as Coinbase. The partnership announced on July 30, 2025, represents a pivotal moment, promising to democratize crypto access for over 80 million Chase customers. This report explores the multifaceted aspects of this collaboration, its potential impact on the crypto market, and the broader financial ecosystem. It examines the specific features being rolled out, the strategic rationale behind the partnership, and the potential future implications for both JPMorgan and Coinbase, as well as their customers.

Three Pillars of Crypto Integration

The JPMorgan-Coinbase partnership is built on three key pillars, each designed to lower the barriers to entry for Chase customers venturing into the world of cryptocurrencies:

1. Direct Bank-to-Wallet Integration

This feature represents a significant leap forward in user experience. By establishing a direct link between Chase bank accounts and Coinbase wallets, customers can seamlessly transfer funds for crypto purchases. This eliminates the friction and potential delays associated with traditional banking transfers, making the process faster, more efficient, and more user-friendly. The use of JPMorgan’s secure API technology underscores the commitment to security and reliability, addressing a key concern for many potential crypto investors. This integration is slated to be available by 2026.

2. Chase Ultimate Rewards Conversion to USDC

The ability to convert Chase Ultimate Rewards points into USDC (USD Coin) marks a groundbreaking innovation. USDC, a stablecoin pegged to the US dollar, provides a stable and readily usable digital currency for crypto transactions. This feature allows Chase customers to leverage their existing rewards points to enter the crypto market without needing to directly spend fiat currency. This approach effectively gamifies crypto adoption, incentivizing participation and potentially attracting a new demographic of users who are already familiar with the Ultimate Rewards program. This is the first instance of a major US rewards program enabling point-to-crypto conversion.

3. Funding Coinbase Accounts with Chase Credit Cards

Starting in Fall 2025, Chase credit cardholders will gain the ability to directly fund their Coinbase accounts using their credit cards. This provides a convenient and familiar method of payment for crypto purchases. However, it’s crucial to acknowledge the inherent risks associated with using credit cards for crypto investments. The volatility of the crypto market, combined with the potential for high interest rates on credit card balances, necessitates responsible usage. Both JPMorgan and Coinbase will likely need to implement safeguards and educational resources to promote responsible credit card usage for crypto purchases.

Strategic Rationale: A Win-Win Scenario

The partnership between JPMorgan and Coinbase is a strategic masterstroke, offering mutual benefits for both entities:

JPMorgan’s Perspective

For JPMorgan, this collaboration represents a calculated move to tap into the burgeoning crypto market without directly exposing itself to the inherent risks of holding and managing cryptocurrencies. By partnering with Coinbase, a leading crypto exchange with established infrastructure and regulatory compliance, JPMorgan can offer its customers access to crypto services while maintaining a safe distance from direct involvement in the volatile crypto asset class. Furthermore, this partnership allows JPMorgan to attract and retain customers who are increasingly interested in crypto investments, bolstering its position as a forward-thinking and innovative financial institution.

Coinbase’s Perspective

For Coinbase, the partnership with JPMorgan provides unparalleled access to a massive customer base. With over 80 million potential users, this collaboration significantly expands Coinbase’s reach and market penetration. The integration with Chase’s banking infrastructure also lends credibility and legitimacy to Coinbase, further solidifying its position as a leading player in the crypto exchange space. This partnership also provides a significant boost to Coinbase’s revenue streams, as it facilitates increased trading activity and attracts new users to its platform. The added convenience of direct bank integration and credit card funding will undoubtedly increase trading volumes on the platform.

Implications and Future Outlook

The JPMorgan-Coinbase partnership has far-reaching implications for the crypto market and the broader financial landscape:

Increased Crypto Adoption

By simplifying the process of buying and holding cryptocurrencies, this partnership is poised to drive significant growth in crypto adoption. The accessibility and convenience offered by the three key features will likely attract a new wave of investors who were previously hesitant to enter the crypto market due to perceived complexity or security concerns.

Mainstream Validation of Crypto

The involvement of a traditional financial giant like JPMorgan lends further legitimacy to the crypto asset class. This partnership signals a growing acceptance of crypto as a viable investment option, potentially paving the way for increased institutional investment and regulatory clarity.

Innovation in Financial Services

This collaboration sets a precedent for future partnerships between traditional financial institutions and crypto-native platforms. The integration of crypto services into traditional banking infrastructure is likely to spur further innovation in the financial services industry, leading to new products and services that bridge the gap between the traditional and decentralized financial worlds.

Potential for Crypto-Backed Loans

Looking ahead, JPMorgan’s consideration of launching crypto-backed loans, using Bitcoin and Ethereum as collateral, signals a deeper integration of crypto into its lending operations. This move, potentially launching as early as next year, could unlock significant liquidity for crypto holders and further legitimize crypto as a mainstream asset class.

Coinbase Acquisition Rumors

While not directly related to the JPMorgan partnership, the recent rumors surrounding Coinbase’s potential acquisition of CoinDCX, an India-based crypto exchange, highlight Coinbase’s ambition to expand its global footprint. Such an acquisition, if realized, would further solidify Coinbase’s position as a leading player in the global crypto exchange market.

Conclusion: A Transformative Alliance

The partnership between JPMorgan Chase and Coinbase represents a transformative alliance that is poised to reshape the landscape of crypto accessibility and integration. By leveraging their respective strengths, both companies are positioned to benefit from the growing adoption of cryptocurrencies. This collaboration not only simplifies crypto purchases for millions of Chase customers but also signals a growing acceptance of crypto as a legitimate asset class within the traditional financial system. As the financial world continues to evolve, this partnership serves as a powerful example of how traditional institutions and crypto-native platforms can collaborate to drive innovation and democratize access to financial services. The future of finance is undoubtedly being shaped by these types of strategic alliances, blurring the lines between the old and the new, and ultimately empowering consumers with greater control over their financial lives.