Navigating the Crypto and NFT Landscape: A Deep Dive into Recent Trends and Insights

Introduction: The Ever-Evolving Crypto and NFT Ecosystem

The cryptocurrency and NFT markets continue to evolve at a rapid pace, with new developments, analyses, and opportunities emerging daily. From reward distributions in decentralized ecosystems to technical analyses of NFT trends, the space remains dynamic and full of potential. This report explores key insights from recent discussions, focusing on creator rewards, NFT market cycles, and emerging DeFi projects.

—

1. Creator Rewards and Ecosystem Distribution

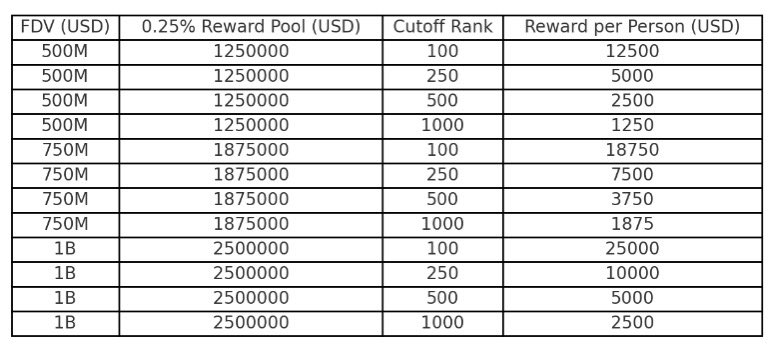

The Boundless XYZ Reward Model

@boundless_xyz recently announced a 0.25% reward for creators through Kaito, though this does not extend to the broader Kaito ecosystem, including skakers and NFT holders. While the percentage itself is reasonable, the distribution method is a critical factor in its success.

According to @soonlidaero’s analysis, the valuation potential of this model depends on how rewards are allocated. If structured fairly, it could incentivize long-term engagement and contribution to the ecosystem. However, if rewards are concentrated among a few, it may lead to centralization and reduced participation.

Key Takeaway: The success of reward mechanisms in decentralized ecosystems hinges on equitable distribution and sustained engagement incentives.

—

2. NFT Market Cycles and Bullish Signals

A Potential Turning Point for NFTs

@dj_david94 highlights a potential turning point in the NFT market, suggesting that 15 million OE (Open Edition) NFTs have completed their bearish cycle. If highs are broken, the market could shift back to a bullish trend.

The analysis emphasizes the importance of lower timeframe (LTF) accumulation feeding into higher timeframe (HTF) trends. If this pattern holds, new all-time highs (ATHs) could be on the horizon.

Key Takeaway: NFT investors should monitor LTF accumulation patterns, as they may signal the next bullish wave.

—

3. The Anoma Testnet: A Competitive Playground

Gaming the Anoma Yapping Testnet

@OOPS_NFT shares their experience with the Anoma Yapping testnet, having accumulated 150,000 points in five days. The post also notes that top-ranked participants remain highly active, with daily rank fluctuations of around 1,000 positions.

This suggests a competitive environment where early and consistent participation can yield significant rewards. As the testnet progresses, strategic engagement may become even more crucial.

Key Takeaway: Early and sustained participation in testnets can provide a competitive edge, but long-term success depends on adaptability and strategy.

—

4. AI-Powered Trading and Market Insights

Trade365days: Empowering Traders with AI

@trade365days positions itself as a go-to platform for real-time insights, technical analysis, and AI-powered trading strategies across stocks, crypto, forex, and commodities. The platform aims to help traders make smarter, data-driven decisions.

With AI becoming increasingly integral to trading, such tools could democratize access to advanced market analysis, benefiting both retail and professional traders.

Key Takeaway: AI-driven trading platforms are reshaping market analysis, offering more accessible and efficient tools for traders.

—

5. The Rise of $AMI in Aptos DeFi

A Solid Foundation for $AMI

@nft_pokeworld highlights $AMI’s growing traction in the Aptos DeFi ecosystem. With real-world utility and community support, $AMI could become a core asset in decentralized finance.

The post suggests that investors should watch $AMI closely, as its fundamentals appear strong.

Key Takeaway: Projects with real utility and community backing are more likely to thrive in competitive DeFi ecosystems.

—

6. Discipline in Trading: A Timeless Principle

The Importance of Discipline in Crypto Trading

@YoCryptoclub emphasizes the critical role of discipline in trading, urging investors to trust their analysis and avoid emotional decisions. This principle remains essential, especially in volatile markets like crypto.

Key Takeaway: Discipline and strategy are more reliable than luck in long-term trading success.

—

7. UMA Alpha: Analyzing $CORRUPTED

A Meme-Themed NFT Project with Potential

@umaonsol provides an alpha analysis of $CORRUPTED, a meme-themed NFT project that critiques internet culture. With a CMC score of 335.0 and a circulating market cap of $3,223, the project is still in its early stages.

Meme NFTs have historically shown volatility but also significant upside potential. Investors should assess whether the project has sustainable engagement beyond short-term hype.

Key Takeaway: Meme NFTs can be high-risk, high-reward investments—due diligence is essential.

—

8. Sonic NFT Market Health Check

Real-Time Insights from Gangsta City

@GangstaLions provides a health check on the Sonic NFT market, highlighting:

– Global marketplace trends (volume, trades)

– Market sentiment analysis

– Summary metrics across PaintSwap

Real-time data is crucial for NFT traders, as it helps identify emerging trends and potential opportunities.

Key Takeaway: Access to real-time NFT market data can provide a competitive advantage in trading.

—

Conclusion: Staying Informed in a Dynamic Market

The crypto and NFT landscapes are in constant flux, with new opportunities and challenges arising daily. Whether it’s reward distribution models, NFT market cycles, or emerging DeFi projects, staying informed and disciplined is key to navigating this space successfully.

As AI tools and real-time analytics become more prevalent, traders and investors will need to adapt quickly. The future of crypto and NFTs will likely be shaped by those who combine data-driven insights with strategic discipline.

—

Sources: