The Legislative Turning Point of Crypto Week and Its Implications

Introduction: A Watershed Moment for Digital Assets

The cryptocurrency landscape is no stranger to volatility, but the recent phenomenon dubbed “Crypto Week” marked a seismic shift not in market prices, but in legislative momentum. This concentrated period of legislative activity in the United States signaled a potential turning point in how digital assets are perceived, regulated, and integrated into the broader financial ecosystem. The events of “Crypto Week” have set the stage for a new era of regulatory clarity, market maturation, and technological innovation.

Legislative Firepower: The Bills That Could Reshape the Industry

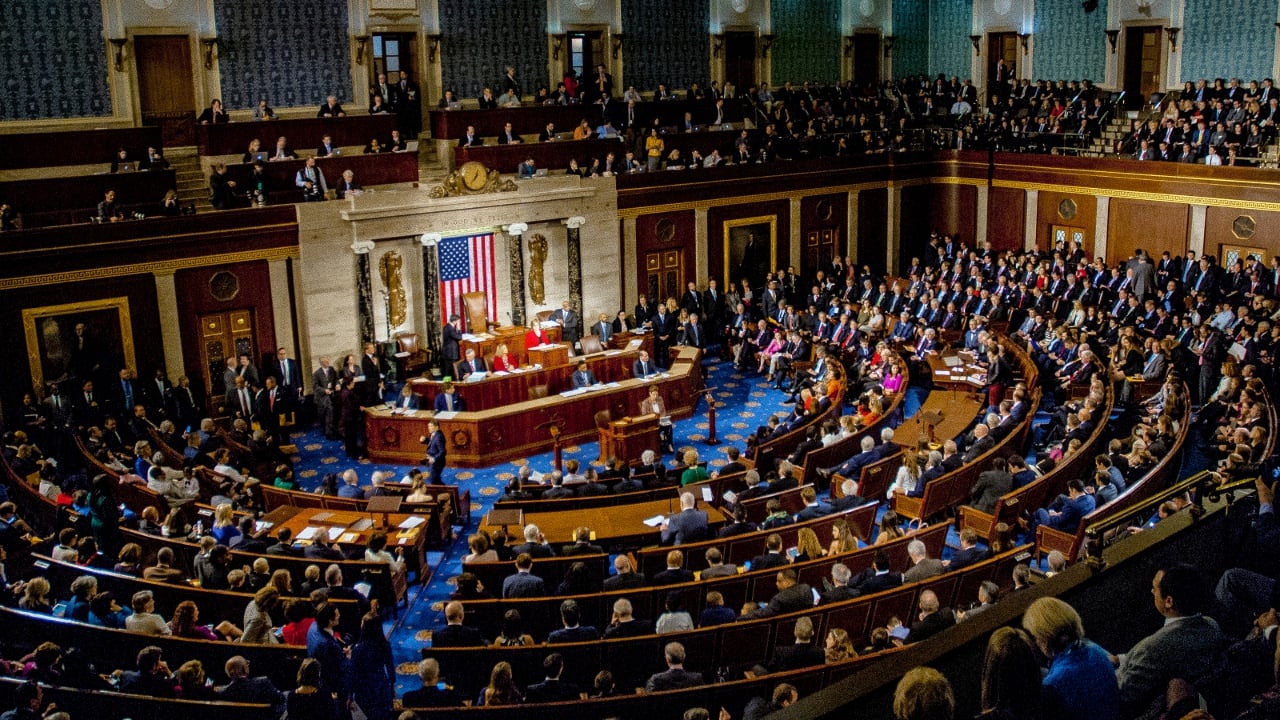

The U.S. House of Representatives took center stage during “Crypto Week,” debating and advancing several key bills that could redefine the regulatory landscape for digital assets. These legislative efforts represent a concerted push to address the ambiguities and challenges that have long plagued the cryptocurrency industry.

The GENIUS Act: Fostering Innovation and Understanding

The GENIUS Act emerged as a cornerstone of “Crypto Week,” aiming to promote innovation and understanding of blockchain technology and digital assets. This legislation seeks to create a more favorable environment for the development and deployment of blockchain-based solutions. By encouraging technological advancement, the GENIUS Act signals a commitment to embracing the transformative potential of digital assets. The passage of this act could accelerate the adoption of blockchain technology across various industries, from finance to supply chain management.

The CLARITY Act: Demystifying Regulatory Ambiguities

The CLARITY Act stands out as a critical piece of legislation designed to bring much-needed clarity to the regulatory landscape. This act aims to define which cryptocurrencies should be classified as securities and which should be treated as commodities. By establishing clear distinctions, the CLARITY Act would enable businesses operating in the crypto space to better navigate the regulatory environment. This clarity is essential for fostering a more stable and predictable market, attracting institutional investors, and ensuring compliance with existing regulations.

The Anti-CBDC Surveillance State Act: Safeguarding Privacy

The Anti-CBDC Surveillance State Act reflects growing concerns about the potential misuse of central bank digital currencies (CBDCs) for surveillance and control. This legislation seeks to prevent the creation of a CBDC that could infringe on citizens’ privacy and financial autonomy. The debate surrounding this act highlights the ongoing tension between government oversight and individual liberties in the digital age. The passage of this act could set a precedent for protecting privacy in the evolving landscape of digital currencies.

Ethereum’s Rise: A Market Narrative Driver

While legislative developments dominated the headlines, Ethereum played a pivotal role during “Crypto Week.” As the second-largest cryptocurrency by market capitalization, Ethereum has become a focal point for innovation and development within the blockchain space. The successful transition to a Proof-of-Stake (PoS) consensus mechanism, known as “The Merge,” has positioned Ethereum as a leading platform for decentralized applications (dApps), decentralized finance (DeFi), and non-fungible tokens (NFTs).

Ethereum’s enhanced scalability, security, and energy efficiency post-Merge have captured the attention of investors and developers alike. The platform’s ability to support a wide range of use cases has made it a primary driver of market sentiment and narrative. Positive developments on the Ethereum platform often lead to increased investor confidence and broader market optimism, underscoring its significance in the cryptocurrency ecosystem.

Potential Impacts on the Cryptocurrency Market

The legislative outcomes of “Crypto Week” have the potential to significantly impact the cryptocurrency market in several ways, shaping its trajectory and fostering a more robust and inclusive financial ecosystem.

Increased Institutional Investment

Regulatory clarity can attract more institutional investors to the cryptocurrency market. Many institutional investors have been hesitant to enter the market due to regulatory uncertainty. With clearer rules and guidelines, they may feel more comfortable allocating capital to digital assets, leading to a surge in market liquidity and prices. This influx of institutional investment could further legitimize the cryptocurrency market and drive its growth.

Enhanced Investor Protection

Clearer regulations can also provide enhanced protection for retail investors. By establishing guidelines for cryptocurrency exchanges, custodians, and other service providers, regulators can help prevent fraud and manipulation. This protection is crucial for building trust in the market and ensuring that retail investors can participate with confidence. Enhanced investor protection could lead to broader adoption and a more stable market environment.

Fostered Innovation

A well-defined regulatory framework can foster innovation in the cryptocurrency space. By providing clear rules of the road, regulators can encourage entrepreneurs and developers to build new and innovative products and services without fear of running afoul of the law. This innovation could lead to the development of groundbreaking technologies and applications that could revolutionize various industries.

Job Creation

As the cryptocurrency industry matures and becomes more regulated, it is likely to create new jobs in areas such as compliance, legal, and technology. The increasing number of job postings related to crypto and blockchain technology on platforms like Indeed.com suggests a growing demand for skilled professionals in this field. This job creation could contribute to economic growth and further solidify the cryptocurrency industry’s role in the broader economy.

Challenges and Concerns

Despite the positive developments during “Crypto Week,” several challenges and concerns remain, highlighting the need for continued vigilance and proactive engagement.

Senate Approval

The bills passed by the House of Representatives still need to be approved by the Senate. The Senate is often more deliberative and less likely to pass legislation quickly, so it is uncertain whether these bills will ultimately become law. The cryptocurrency community must remain engaged in the legislative process and advocate for the passage of these critical bills.

Implementation

Even if the bills are passed into law, the implementation of the regulations could be challenging. Regulators will need to develop clear and consistent guidelines and enforcement mechanisms to ensure that the regulations are effectively implemented. The cryptocurrency community must work closely with regulators to ensure that the implementation process is smooth and effective.

Potential for Overregulation

There is also a risk that regulators could overregulate the cryptocurrency industry, stifling innovation and driving businesses overseas. It is important for regulators to strike a balance between protecting investors and fostering innovation. The cryptocurrency community must advocate for regulations that are both protective of investors and supportive of innovation.

Conclusion: A Cautiously Optimistic Future

“Crypto Week” represents a potentially landmark moment for the cryptocurrency industry. The passage of key bills by the House of Representatives signals a growing recognition among lawmakers of the importance of digital assets and the need for a clear regulatory framework. This legislative progress, coupled with Ethereum’s continued innovation and market dominance, suggests a potentially bright future for the cryptocurrency industry.

However, it is important to remain cautiously optimistic. The bills still need to be approved by the Senate, and the implementation of the regulations could be challenging. Moreover, there is a risk of overregulation that could stifle innovation.

The Road Ahead: Continued Engagement and Vigilance

The cryptocurrency community must remain engaged in the legislative process and advocate for regulations that are both protective of investors and supportive of innovation. Continued dialogue between industry participants, regulators, and lawmakers is essential to ensure that the future of digital assets is one of responsible growth and widespread adoption. Only through vigilance and proactive engagement can the industry capitalize on the momentum of “Crypto Week” and build a sustainable and thriving ecosystem for digital assets. The road ahead is filled with opportunities and challenges, but with a collective effort, the cryptocurrency industry can navigate this path and achieve its full potential.