The Evolution and Future of NFTs: A Deep Dive into Market Trends and Whale Behavior

Introduction: The NFT Market’s Rollercoaster Ride

The Non-Fungible Token (NFT) market has been on a wild ride since its inception. From the explosive growth in early 2021 to the subsequent corrections and resurgence, the space has seen dramatic shifts in trading volumes, investor behavior, and technological advancements. Recent analyses suggest that despite past volatility, the NFT ecosystem remains robust, with key indicators pointing toward long-term potential.

This report explores the latest trends in NFT trading volumes, whale activity, and emerging platforms, providing insights into what the future may hold for digital collectibles.

—

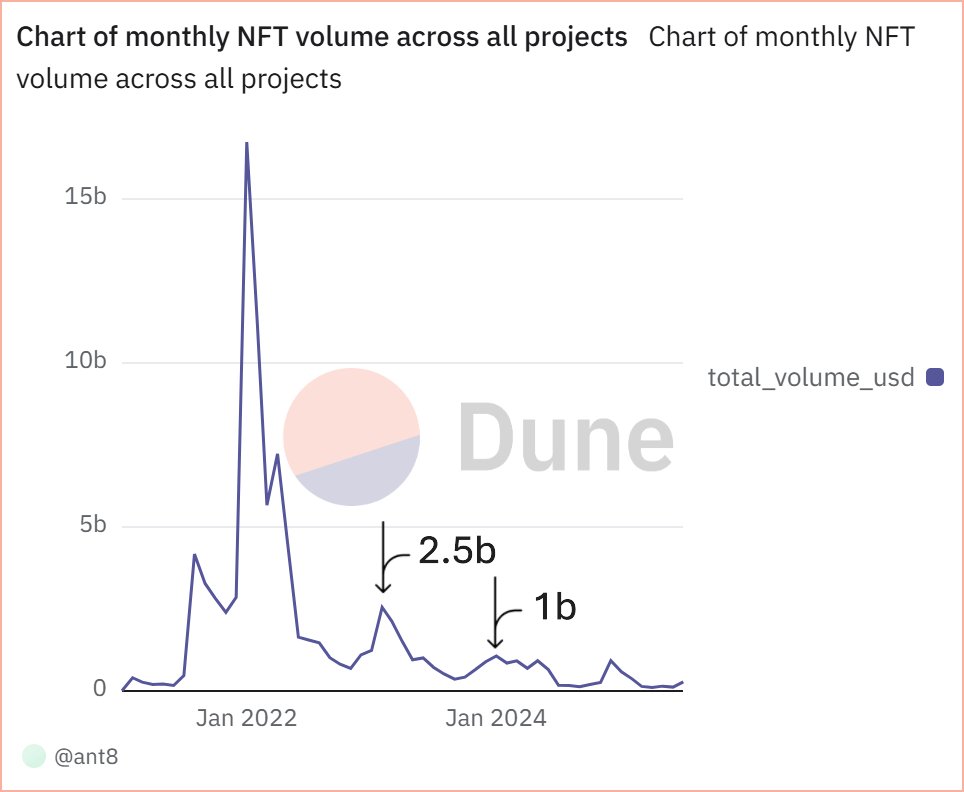

1. Monthly NFT Volume Analysis: A Bullish Outlook

The 2022 Peak and Subsequent Decline

A recent analysis of monthly NFT trading volumes in USD reveals a striking pattern. The market experienced a massive surge around January and February 2022, coinciding with the peak of the crypto bull run. However, this was followed by a sharp decline, which gradually stabilized through 2023 and into 2024.

Despite this correction, the data suggests that the market is far from dead. Instead, it may be undergoing a maturation phase, where speculative hype gives way to more sustainable growth.

Signs of a Resurgence

While the overall volume has declined from its peak, there are indications of renewed interest. Smaller but consistent trading activity suggests that the market is stabilizing, with long-term holders and institutional investors gradually re-entering the space.

—

2. Emerging Trends in NFT Platforms and Tools

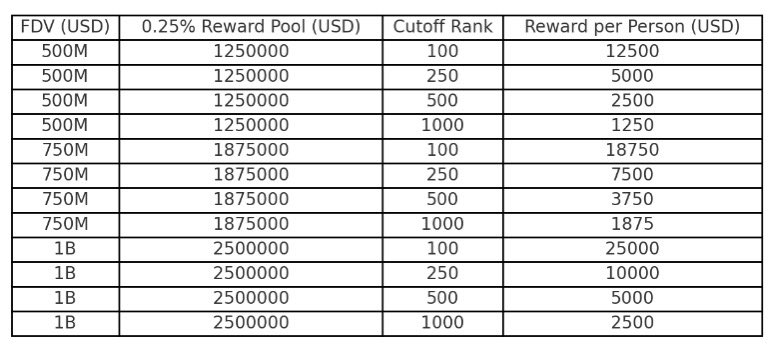

Bitlock Wallet: A New Player in the Crypto Wallet Game

Bitlock Wallet has announced a series of updates aimed at enhancing user experience and expanding functionality. Over the next 14 days, the platform will introduce:

– Advanced token analysis – Deeper insights into token performance and market trends.

– New chain support – Expanded compatibility with multiple blockchain networks.

– Trending tokens section – A curated list of high-potential tokens.

– NFT support – Integration of NFT trading and management.

– Referral system – Incentives for users to bring in new participants.

These updates position Bitlock as a strong contender in the competitive crypto wallet space, potentially attracting a broader user base.

—

3. Whale Activity: A Key Indicator of Market Sentiment

The “Purt the Adventure” Whale Wallet

A notable observation comes from a whale wallet holding 1,518 tokens of the “Purt the Adventure” collection, created by Red Planet DAO. What makes this particularly interesting is that the wallet has never listed a single token for sale—instead, it recently acquired 24 more tokens.

This behavior suggests strong confidence in the project’s future value, potentially signaling an upcoming price surge. Such whale activity often precedes significant market movements, making it a critical metric for traders and analysts.

Chimpers NFT: A Case Study in Long-Term Holder Loyalty

Further analysis of the Chimpers NFT collection reveals fascinating insights:

– 6,936 wallets have ever held a Chimpers NFT.

– 1,822 wallets (26.2%) have never sold their tokens, indicating strong belief in the project’s long-term value.

This high retention rate is unusual in the NFT space, where many holders tend to flip assets quickly. The fact that nearly a quarter of Chimpers holders remain committed suggests a dedicated community and potential future appreciation.

—

4. Historical NFT Volume Trends: A Five-Year Perspective

July’s Performance Over the Past Five Years

A deeper look into NFT trading volumes in Ethereum (ETH) over the past five Julys shows a fluctuating but resilient market. While some years saw significant dips, others experienced unexpected surges, often tied to broader crypto market conditions.

This historical data reinforces the idea that NFTs, like other crypto assets, are subject to cyclical trends. However, the increasing institutional interest and technological advancements suggest that the market is evolving beyond speculative trading.

—

Conclusion: The Future of NFTs – Stability, Innovation, and Opportunity

The NFT market has come a long way since its early days of hype and speculation. While trading volumes have fluctuated, the underlying fundamentals—such as whale accumulation, long-term holder loyalty, and platform innovations—indicate a maturing ecosystem.

As new tools like Bitlock Wallet enhance accessibility and security, and as whale behavior continues to influence market trends, the NFT space is poised for sustained growth. The key takeaway? The market is not dead—it’s evolving, and those who understand its dynamics stand to benefit from its next wave of innovation.

—

Sources