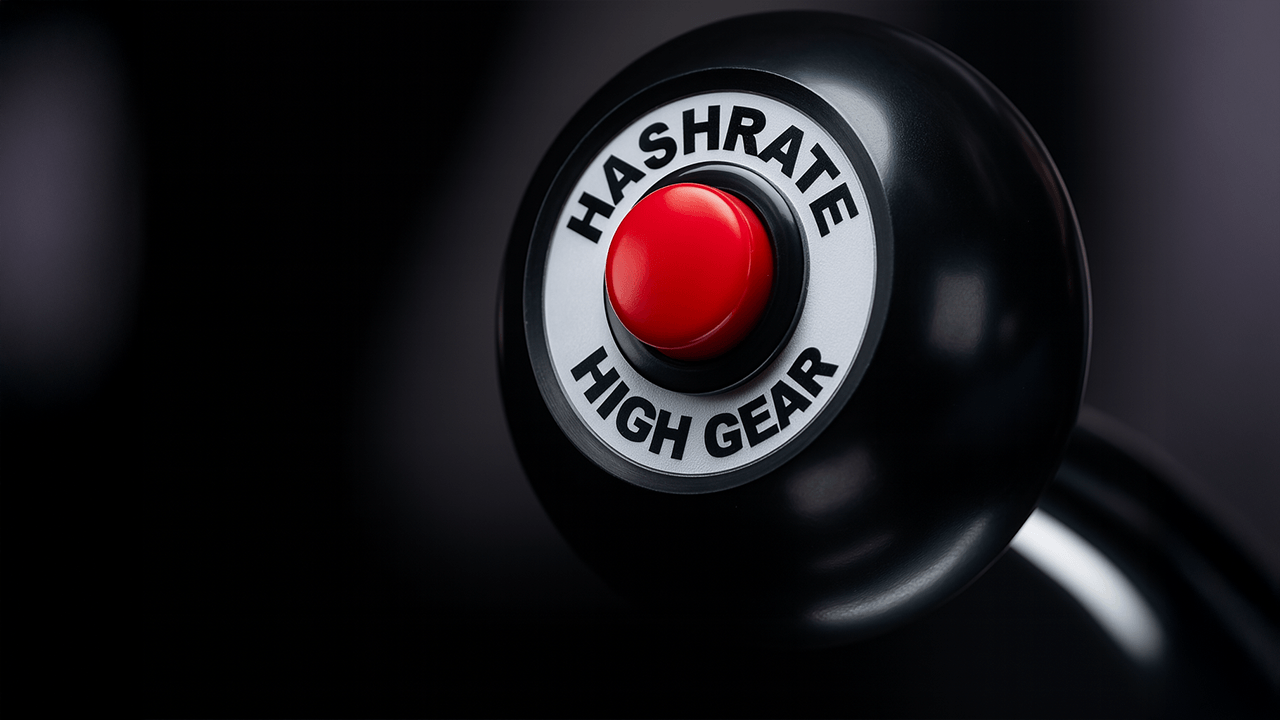

The Significance of Bitcoin’s Hashrate Surge: A Comprehensive Analysis

Introduction: The Digital Fortress

Bitcoin, the world’s first decentralized digital currency, has long been hailed as a revolutionary financial instrument. Its underlying technology, blockchain, is a distributed ledger that records transactions across a network of computers. The security of this ledger is maintained by a process called mining, which involves solving complex mathematical puzzles to validate transactions and add new blocks to the chain. The computational power dedicated to this process is measured by the hashrate, a critical metric that reflects the health and security of the Bitcoin network.

In recent times, Bitcoin’s hashrate has surged to unprecedented levels, signaling a robust and increasingly secure network. This surge is not merely a technical achievement but a reflection of broader trends in the Bitcoin ecosystem, including the rise of professional mining operations, the impact of market dynamics, and the evolving regulatory landscape. This report delves into the implications of this hashrate surge, exploring its causes, consequences, and the future of Bitcoin mining.

Understanding the Hashrate: The Backbone of Bitcoin Security

What is the Hashrate?

The hashrate is a measure of the total computational power dedicated to mining Bitcoin. It is expressed in exahashes per second (EH/s) or zettahashes per second (ZH/s), representing the number of hashes (a cryptographic function) that miners perform per second. Each hash is an attempt to solve the mathematical puzzle required to validate a block of transactions and add it to the blockchain.

Why Does the Hashrate Matter?

The hashrate is a critical indicator of the security and decentralization of the Bitcoin network. A higher hashrate means that more miners are participating in the network, making it more difficult for any single entity to gain control or manipulate the blockchain. This decentralization is a core principle of Bitcoin, ensuring that no single point of failure exists and that the network remains resilient against attacks.

The Role of Miners

Miners play a pivotal role in the Bitcoin ecosystem. They provide the computational power necessary to secure the network and validate transactions. In return, they are rewarded with newly minted bitcoins and transaction fees. The hashrate surge indicates that more miners are joining the network, driven by profitability and the belief in Bitcoin’s long-term potential.

The Rise of Public Miners: A New Era in Bitcoin Mining

The Shift from Hobbyists to Professionals

In the early days of Bitcoin, mining was a hobbyist activity, with individuals setting up mining rigs in their basements or garages. However, as the network grew, so did the complexity and cost of mining. Today, mining is dominated by professional operations, often backed by significant capital and sophisticated infrastructure.

The Dominance of Public Miners

Publicly-listed Bitcoin mining companies have emerged as major players in the industry. These companies, such as Riot Blockchain, Marathon Digital, and Bitfarms, have access to substantial resources and are able to scale their operations rapidly. They contribute a significant portion of the overall hashrate, reflecting the maturation of the Bitcoin mining industry.

Centralization Concerns

While the rise of public miners has brought efficiency and scalability to the industry, it has also raised concerns about centralization. A concentration of mining power in the hands of a few large entities could potentially lead to vulnerabilities. The Bitcoin community remains vigilant in monitoring this trend and advocating for measures that promote decentralization.

The Bullish Price Correlation: Miners and Market Dynamics

The Symbiotic Relationship

The hashrate is closely tied to the price of Bitcoin. When the price rises, mining becomes more profitable, attracting more miners to the network and increasing the hashrate. Conversely, a declining price can lead to a contraction in the hashrate as some miners find it unprofitable to continue operating.

Miner Sentiment and Network Health

The hashrate can serve as a valuable indicator of miner sentiment and the overall health of the Bitcoin ecosystem. A sustained increase in the hashrate often suggests that miners are confident in Bitcoin’s long-term prospects and are willing to invest in expanding their operations.

The Halving Effect

The halving events, which occur approximately every four years, reduce the block subsidy (the reward miners receive for adding new blocks to the blockchain) by 50%. This reduction in revenue necessitates greater efficiency and innovation for miners to remain profitable. The upcoming halving in 2024 is expected to have a significant impact on the hashrate and the overall mining landscape.

Challenges and Headwinds: Navigating the Mining Landscape

Increasing Mining Difficulty

As more miners join the network and the hashrate rises, the difficulty of solving the cryptographic puzzles increases proportionally. This dynamic adjustment ensures that new blocks are added to the blockchain at a consistent rate, maintaining the integrity of the Bitcoin protocol.

Energy Consumption and Sustainability

The energy consumption of Bitcoin mining has come under increasing scrutiny. Critics argue that the industry’s reliance on fossil fuels contributes to environmental degradation. However, many miners are actively transitioning to renewable energy sources, such as solar, wind, and geothermal, to reduce their carbon footprint and promote sustainable mining practices.

Regulatory Uncertainty

Geopolitical events and regulatory uncertainty can significantly impact the Bitcoin mining industry. Government crackdowns, fluctuations in energy prices, and changes in tax policies can all create headwinds for miners. The decentralized nature of the network and the global distribution of miners make it difficult for any single entity or government to exert undue influence.

The Future of Bitcoin Mining: Innovation and Adaptation

Technological Advancements

The Bitcoin mining industry is constantly evolving, driven by technological innovation and market forces. Advancements in mining hardware, such as more efficient ASICs (Application-Specific Integrated Circuits), are enabling miners to achieve greater hashrate with lower energy consumption.

Diversification of Revenue Streams

Miners are increasingly exploring novel ways to monetize their operations, such as providing ancillary services to the Bitcoin network or participating in decentralized finance (DeFi) protocols. These innovations are helping miners to diversify their revenue streams and enhance their profitability.

The Role of Renewable Energy

The transition to renewable energy sources is not only a response to environmental concerns but also a strategic move to reduce operational costs. Miners are increasingly locating their operations in regions with abundant renewable energy, such as hydroelectric power in Canada and geothermal energy in Iceland.

Conclusion: A Resilient and Evolving Network

The surge in Bitcoin’s hashrate is a testament to the resilience and adaptability of the Bitcoin network. It reflects the growing confidence in Bitcoin’s long-term potential as a decentralized, censorship-resistant store of value and medium of exchange. As the network continues to mature and gain wider adoption, the hashrate is likely to continue its upward trajectory, solidifying Bitcoin’s position as a cornerstone of the digital economy.

The story of Bitcoin’s hashrate is more than just a tale of technological progress. It is a narrative of resilience, adaptation, and unwavering belief in the power of decentralization. As the hashrate reaches new heights, it serves as a powerful reminder that Bitcoin is not just a cryptocurrency; it is a digital fortress, built to withstand the test of time.