Bitmain’s Strategic Pivot: Navigating US Tariffs and Market Dynamics

The Shifting Sands of Global Bitcoin Mining

The Bitcoin mining industry is a dynamic and highly competitive landscape, where adaptability is not just an advantage but a necessity. As geopolitical forces and market dynamics evolve, companies must demonstrate agility to maintain their competitive edge. Bitmain, the world’s leading manufacturer of Bitcoin mining rigs, is currently at a critical juncture. Faced with potential tariffs and a changing market environment, the company is undertaking a strategic shift that could reshape the future of its operations and the broader mining industry. This report explores Bitmain’s recent actions, analyzing the motivations, implications, and potential challenges associated with its move to localize assembly and manufacturing within the United States.

The Tariff Tightrope: Bitmain’s Response to Trade Pressures

The threat of tariffs has long been a significant concern for international trade, and the Bitcoin mining sector is no exception. Under the previous U.S. presidential administration, tariffs were imposed on a range of Chinese goods, including electronic components essential for the production of Bitcoin mining equipment. These tariffs substantially increased the cost of importing fully assembled Antminers, Bitmain’s flagship product, into the U.S. market.

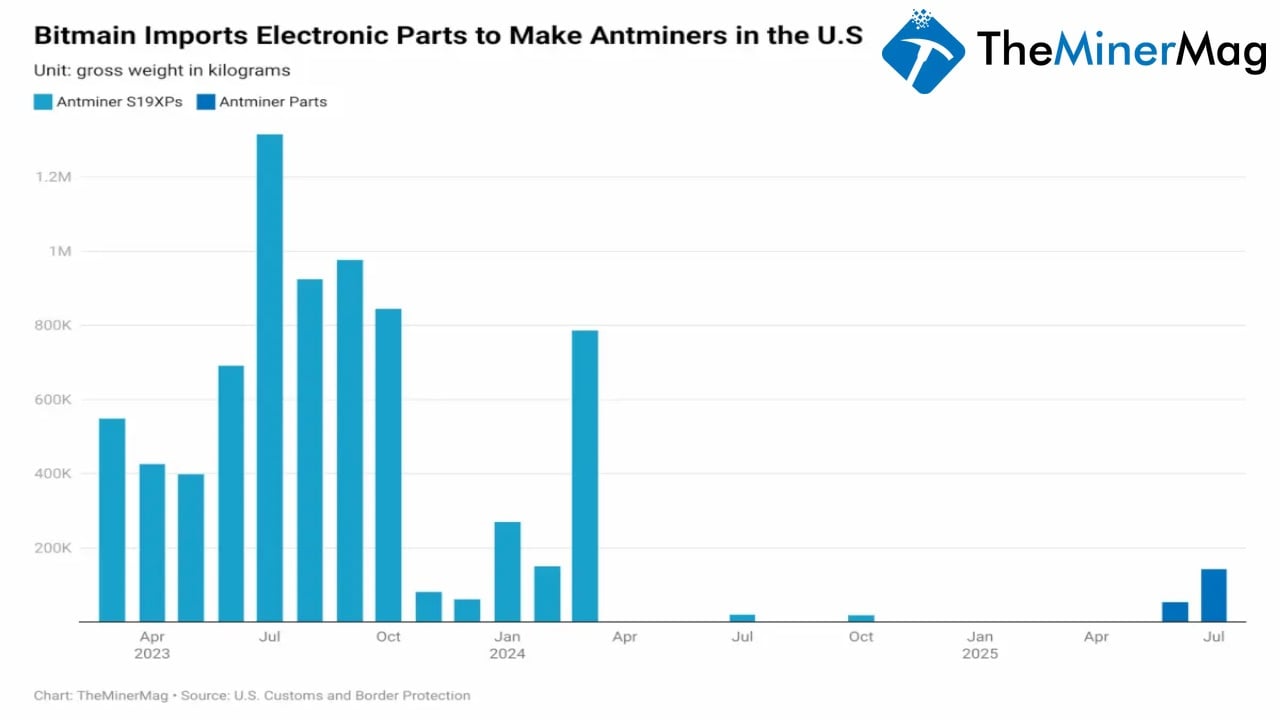

In response to these tariff pressures, Bitmain has adopted a proactive strategy: shipping disassembled Antminer parts to the United States for local assembly. Recent reports indicate that Bitmain has transported approximately 187 tons (187,000 kg) of electronic components to the U.S., specifically targeting a subsidiary in Delaware. This approach allows the company to circumvent tariffs on finished goods by importing components and assembling the miners within the U.S., effectively reclassifying them as domestically produced goods.

This strategy is reminiscent of a similar approach adopted by MicroBT, another major player in the Bitcoin mining hardware market, in 2023. By establishing a local assembly presence, Bitmain aims to significantly reduce its tariff burden and maintain its competitive pricing in the crucial North American market.

Beyond Tariffs: A Holistic Approach to Market Challenges

While avoiding tariffs is a primary driver, Bitmain’s decision to localize assembly is also influenced by other factors, including post-halving market dynamics and regulatory uncertainty.

The Bitcoin halving, which occurs approximately every four years, reduces the block reward given to miners, effectively cutting their revenue in half. This event typically leads to increased competition among miners, as only the most efficient operations can remain profitable. In a post-halving environment, cost optimization becomes even more critical, and Bitmain’s strategy to lower tariff-related expenses directly addresses this need.

Furthermore, the regulatory landscape surrounding Bitcoin mining in the U.S. remains uncertain. By establishing a physical presence within the country, Bitmain can potentially navigate these regulations more effectively and demonstrate its commitment to compliance. This localized approach may also foster stronger relationships with North American customers and build trust with regulators.

The Delaware Gamble: Weighing Costs and Benefits

Bitmain’s decision to establish its assembly operations in Delaware presents both opportunities and challenges. While Delaware offers a business-friendly environment with established infrastructure, the success of this venture hinges on careful cost management.

Shipping disassembled components incurs transportation costs that must be balanced against the savings from tariff avoidance. Bitmain must optimize its supply chain and logistics to minimize these expenses. Furthermore, the company must ensure the quality and efficiency of its assembly operations in Delaware to maintain the performance standards of its Antminers.

The competitive landscape of the Bitcoin mining hardware market is another critical factor. While Bitmain is a dominant player, it faces competition from other manufacturers, including those already established in the U.S. Bitmain must demonstrate that its localized assembly strategy can deliver cost-effective and high-quality mining rigs to maintain its market share.

Navigating Customs and Regulatory Hurdles

Bitmain’s strategic shift isn’t without potential obstacles. Recent reports indicate that U.S. Customs and Border Protection (CBP) has been detaining shipments of Bitmain Antminers at various ports of entry. These delays have resulted in significant fees for some mining companies, exceeding $200,000 in certain cases.

The reasons for these detentions remain unclear, but industry speculation suggests that the CBP may be scrutinizing the shipments for potential violations of regulations related to intellectual property, country of origin, or sanctions. The Federal Communications Commission (FCC) has reportedly requested the CBP to hold certain shipments of Bitmain ASIC miners, further complicating the situation.

These regulatory hurdles underscore the challenges that Bitmain faces in navigating the complex legal and trade environment in the U.S. The company must work closely with customs officials and legal experts to ensure compliance with all applicable regulations and avoid further delays in its shipments.

The Road Ahead: Localization as a Long-Term Strategy

Bitmain’s decision to funnel Antminer parts to the U.S. for local assembly represents a significant strategic shift. While initially motivated by the desire to avoid tariffs, this move also reflects a broader recognition of the importance of the North American market and the need to adapt to evolving regulatory and competitive dynamics.

Looking ahead, Bitmain may consider further expanding its U.S. operations beyond assembly to include manufacturing and research and development. This deeper level of localization could provide greater control over its supply chain, reduce transportation costs, and foster innovation. Furthermore, a stronger U.S. presence could enhance Bitmain’s reputation and build trust with North American customers and regulators.

However, Bitmain must carefully manage the costs and complexities associated with establishing and operating a manufacturing facility in the U.S. The company must also navigate the evolving regulatory landscape and address any potential challenges related to customs and trade.

Conclusion: A New Chapter for Bitmain

Bitmain’s strategic response to U.S. tariffs marks a significant turning point for the company and the broader Bitcoin mining industry. By embracing localized assembly and manufacturing, Bitmain is not only mitigating the impact of tariffs but also positioning itself for long-term success in the crucial North American market. The road ahead may be fraught with challenges, but Bitmain’s willingness to adapt and innovate suggests that it is well-equipped to navigate the evolving landscape of global Bitcoin mining. This strategic pivot could very well redefine Bitmain’s future, proving that in the dynamic world of cryptocurrency, agility is the ultimate key to survival.