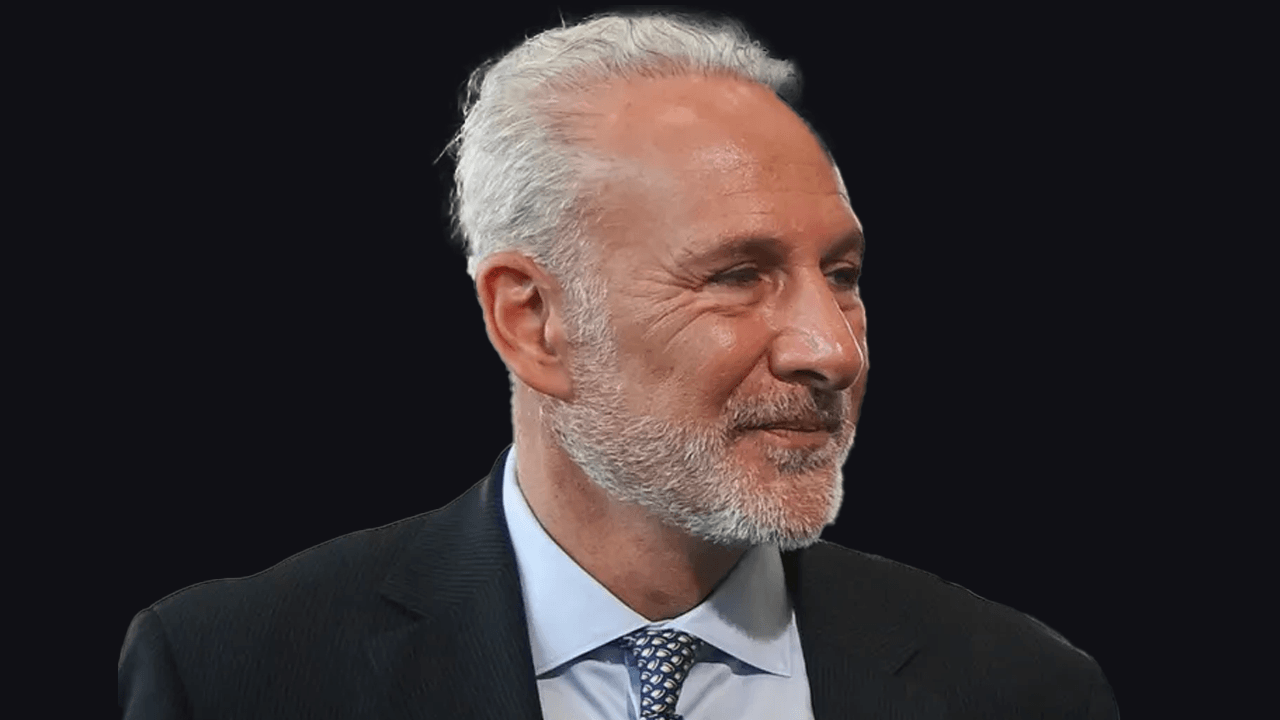

The labor market, a critical barometer of economic health, is a constant subject of scrutiny and debate. Economist Peter Schiff has carved out a niche for himself as a vocal critic of mainstream economic narratives, often challenging conventional wisdom regarding employment data and its interpretation. His perspectives, while sometimes controversial, offer a valuable counterpoint to the often-rosy picture painted by official reports and government pronouncements. This analysis delves into Schiff’s criticisms of recent job reports, his broader views on the labor market, and the implications of his arguments for understanding the true state of the economy.

The June Jobs Report: A Target of Skepticism

Schiff has been particularly critical of the U.S. Bureau of Labor Statistics (BLS) reports, specifically targeting the composition of job gains. He argues that a significant portion of newly created jobs are concentrated in “non-productive” sectors, such as government, healthcare, and social services. In June, he contended that 92% of the 147,000 jobs created fell into these categories. This criticism raises several important questions. What constitutes a “productive” job? Is there inherent value in government, healthcare, and social services sectors? Schiff’s perspective suggests a bias towards sectors that directly contribute to wealth creation, such as manufacturing and technology. While these sectors are undoubtedly crucial for long-term economic growth, dismissing the value of jobs in healthcare and social services overlooks their essential role in maintaining social well-being and supporting a healthy workforce. A healthy population is a productive population. It can be argued that these jobs, while not directly producing tangible goods, are essential for a functioning economy.

Schiff’s critique also implicitly challenges the methodology used by the BLS to calculate job creation. The BLS relies on surveys of businesses and households, which are subject to statistical errors and potential biases. While the BLS strives for accuracy, critics argue that its models may not fully capture the nuances of the labor market, particularly in a rapidly changing economic landscape. For instance, the rise of remote work and the gig economy has introduced new complexities that traditional surveys may not adequately address. Additionally, the BLS’s seasonal adjustments and statistical smoothing techniques can sometimes obscure underlying trends, leading to a distorted picture of the labor market’s true health.

Beyond the Headlines: Digging Deeper into Labor Market Data

Schiff’s skepticism extends beyond specific job reports. He argues that the headline unemployment rate, often touted as a key indicator of economic health, can be misleading. The unemployment rate only counts individuals who are actively seeking employment. It excludes those who have given up looking for work or are underemployed (working part-time but desiring full-time employment). These factors, Schiff contends, paint a more accurate picture of labor market weakness. The U-6 unemployment rate, which includes these groups, is often significantly higher than the headline rate, highlighting the limitations of the traditional metric.

Moreover, Schiff highlights the issue of wage stagnation. While job growth may occur, wages have not kept pace with inflation, eroding the purchasing power of workers. This phenomenon contributes to economic insecurity and weakens overall demand. The rise of the “gig economy,” characterized by temporary and contract-based work, has further exacerbated wage stagnation and job insecurity. These jobs often lack the benefits and stability of traditional employment, leaving workers vulnerable to economic shocks. The lack of job security and benefits in these roles can lead to a cycle of financial instability, where workers are unable to save or invest in their future, further stifling economic growth.

The Role of Government and Monetary Policy

Schiff’s critique of the labor market is intertwined with his broader views on government intervention and monetary policy. He is a staunch advocate of free markets and limited government, arguing that government spending and intervention distort the economy and create artificial bubbles. He believes that the Federal Reserve’s easy money policies, such as low-interest rates and quantitative easing, have fueled inflation and created a false sense of economic prosperity. Schiff contends that government spending on “non-productive” sectors diverts resources from wealth-creating activities, hindering long-term economic growth. He advocates for fiscal austerity and a return to sound money principles, arguing that these policies would create a more sustainable and robust economy.

His views contrast sharply with those of Keynesian economists, who argue that government spending can stimulate demand and create jobs during economic downturns. The debate between these two schools of thought highlights the fundamental differences in their understanding of how the economy works and the role of government in managing it. For instance, Keynesian policies were instrumental in the post-World War II economic boom, while Schiff’s approach aligns more with the laissez-faire economics of the 19th century. The effectiveness of these policies depends on the economic context, and the ongoing debate underscores the need for a balanced approach that considers both short-term stabilization and long-term growth.

The Global Context: China and the Labor Market

Schiff’s analysis of the labor market also considers the global context, particularly the role of China. He argues that China’s economic rise has been fueled by its access to cheap labor and its ability to produce goods at lower costs than the United States. This has led to a decline in manufacturing jobs in the United States and a trade imbalance that, according to Schiff, undermines the American economy. He rejects the notion that the United States is China’s “best customer,” arguing that China benefits more from the trade relationship than the United States. He advocates for policies that would promote domestic manufacturing and reduce reliance on imports from China.

The trade relationship between the United States and China is complex and multifaceted. While China’s manufacturing capabilities have indeed led to job losses in the U.S., they have also contributed to lower consumer prices and a broader range of goods available to American consumers. The trade deficit with China is a contentious issue, with some economists arguing that it reflects broader structural issues in the U.S. economy, such as a lack of investment in education and infrastructure, rather than just trade policies. Schiff’s call for a reduction in reliance on Chinese imports aligns with broader discussions about supply chain resilience and national security, particularly in light of recent global disruptions.

The Contrarian’s Stance: Why Schiff Matters

Peter Schiff’s views on the labor market are often contrarian, challenging the prevailing wisdom and provoking debate. While his criticisms may sometimes be seen as overly pessimistic or simplistic, they serve as a valuable reminder to look beyond the headlines and to critically examine the underlying data. His focus on the quality of jobs, wage stagnation, and the role of government provides a more nuanced understanding of the complexities of the labor market. Schiff’s voice is particularly important in an era of increasing economic uncertainty. The COVID-19 pandemic has disrupted labor markets around the world, creating new challenges and exacerbating existing inequalities. As the economy recovers, it is crucial to have a diversity of perspectives to inform policy decisions and to ensure that the benefits of growth are shared more equitably.

Beyond Optimism and Pessimism: A Call for Critical Thinking

Ultimately, understanding the labor market requires moving beyond simplistic narratives of optimism and pessimism. It demands a critical analysis of the data, a consideration of the underlying trends, and an awareness of the different perspectives that shape our understanding of the economy. Peter Schiff’s criticisms, while not always universally accepted, contribute to this critical discourse and encourage a more informed and nuanced understanding of the labor market and its role in shaping our economic future. The labor market is a dynamic and complex system, influenced by a myriad of factors, from technological advancements to global trade policies. By engaging with diverse viewpoints, policymakers, economists, and the public can better navigate the challenges and opportunities that lie ahead.