The integration of artificial intelligence (AI) into the Bitcoin ecosystem—and more broadly, the cryptocurrency market—is rapidly transforming how participants interact, analyze, and make decisions. From sophisticated trading algorithms to enhanced security and network optimization, AI technologies are becoming pivotal in navigating the complexity and volatility inherent in the crypto world. This report unpacks the multifaceted role of AI within Bitcoin markets and infrastructure, elaborating on its benefits, challenges, and future prospects.

—

Unlocking the Power of AI in Bitcoin Trading

The cryptocurrency market, particularly Bitcoin, is known for its high volatility and rapid price swings, which can offer lucrative opportunities but also significant risks. Traditional manual analysis often falls short in timing entries, exits, and managing risk efficiently. This is where AI steps in with its ability to process vast datasets, identify patterns invisible to human eyes, and execute decisions at lightning speeds.

AI-driven trading platforms employ machine learning models and evolutionary algorithms to analyze everything from historical price movements and order book depth to social sentiment and macroeconomic indicators. This comprehensive approach assists traders by providing predictive signals, automated alerts, and risk assessments, helping reduce the influence of emotional biases such as fear and greed—common pitfalls in trading behavior.

One example highlighted in recent months is Scorehood AI, which uses evolutionary algorithms that adapt to changing market conditions, fine-tuning their models to improve accuracy continuously. Users benefit from insights like potential price liquidations and trend reversals, granting a competitive edge in fast-moving markets.

However, reliance on AI is not a panacea. While algorithmic trading boosts efficiency and accuracy, it introduces unique risks: overfitting to past data, vulnerability to unforeseen black swan events, and the potential amplification of market volatility through algorithmic feedback loops. Therefore, human oversight remains crucial to interpret AI outputs contextually and adjust strategies dynamically.

—

Enhancing Security and Efficiency in Bitcoin Networks with AI

Beyond trading, AI finds applications in bolstering Bitcoin’s underlying network security and efficiency. Mining operations, which validate transactions through solving cryptographic puzzles, can leverage AI techniques to optimize energy consumption and hardware performance—vital factors given rising network difficulty and increasing operational costs.

AI-powered predictive analytics help miners forecast network difficulty adjustments and identify optimal times for mining or power-source shifts, enabling better resource allocation. For instance, integrating AI with smart energy grids can allow mining operations to switch dynamically to renewable or cheaper energy sources, reducing carbon footprint and boosting sustainability.

Moreover, AI algorithms can aid in identifying anomalous network behaviors indicative of potential security threats, such as 51% attacks or suspicious transaction patterns. This proactive detection improves the resilience and trustworthiness of the Bitcoin blockchain.

—

AI’s Role in Developing Layer 2 Solutions and Decentralized Finance

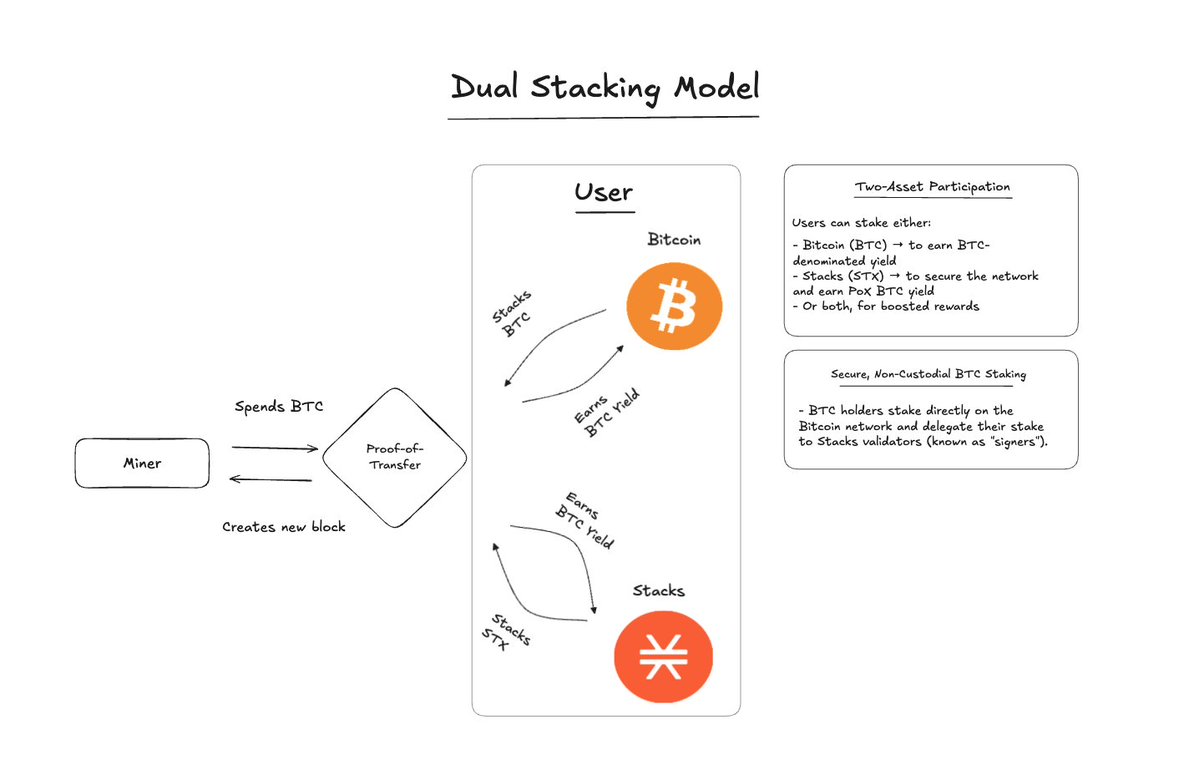

Innovations in Bitcoin Layer 2 technologies, like Stacks and SatLayer, aim to expand Bitcoin’s capabilities by enabling faster transactions and smart contract functionalities. AI complements these efforts by enhancing scalability solutions through intelligent routing and transaction prioritization.

For example, AI can analyze network congestion and predict optimal transaction pathways, minimizing latency and fees on Layer 2 networks. Additionally, in decentralized finance (DeFi) protocols built on Bitcoin’s Layer 2, AI-driven smart contracts can execute more complex, adaptive strategies—for lending, borrowing, or yield farming—based on real-time market data and user behavior.

These advancements increase the usability of Bitcoin beyond simple transfers, fostering a more vibrant programmable financial ecosystem that can respond fluidly to market dynamics.

—

Challenges and Ethical Considerations

While AI’s benefits in Bitcoin markets are clearly compelling, this integration also raises significant challenges. Transparency of AI decision-making remains limited; the “black box” nature of many machine learning models complicates understanding how precisely signals and actions are derived. This lack of explainability can pose trust issues among users and regulators.

There is also a risk that AI-enabled trading algorithms could contribute to flash crashes or exacerbate instability during market stress, as algorithms react simultaneously to the same signals. Coordinated regulatory frameworks and best practices for AI deployment may be necessary to mitigate systemic risks in crypto markets.

Lastly, ethical considerations around data privacy, market fairness, and accessibility emerge. AI tools might disproportionately benefit those with more resources or technical expertise, potentially widening disparities within the crypto ecosystem.

—

Looking Ahead: A Symbiotic Future for AI and Bitcoin

The intertwining of AI and Bitcoin is more than a fleeting trend—it represents a paradigm shift towards smarter, more agile, and resilient cryptocurrency markets and infrastructures. As AI continues to mature, expect deeper integration with Layer 2 protocols, mining optimization, and trading strategies.

Future developments might include decentralized AI systems operating within blockchain environments, enabling community-driven model training and decision-making that respect Bitcoin’s core ethos of decentralization.

For users and investors, cultivating AI literacy alongside blockchain knowledge will become increasingly important. Embracing AI as an insightful partner rather than a deterministic oracle can empower participants to harness its strengths while maintaining critical judgment.

—

Conclusion: Navigating an AI-Enhanced Bitcoin Ecosystem

Artificial intelligence is fundamentally reshaping how Bitcoin is mined, transacted, and traded. Its capacity to process complex data, optimize resource use, and generate predictive insights holds great promise for this dynamic ecosystem.

However, the road ahead calls for balanced integration—acknowledging AI’s limitations, ensuring transparency, and guarding against unintended consequences. By doing so, the Bitcoin community can leverage AI to build a more efficient, secure, and inclusive financial future.

The marriage of AI and Bitcoin is a bold experiment in technology and trust—one that redefines not only markets but also how humans collaborate with intelligent machines in the unfolding narrative of digital currency.

—

References for Further Exploration

– Scorehood AI Trading Platform

– AI in Cryptocurrency Trading: Trends and Tools

– Optimizing Bitcoin Mining with AI

– Stacks Protocol and Layer 2 AI Opportunities

– Blockchain Security and AI Integration

These resources provide additional insights into the evolving synergy between AI technologies and the Bitcoin landscape.