The Rise of On-Chain Analysis in the Crypto and NFT Ecosystems

Introduction: The Blockchain Detective Story

Imagine being able to peek behind the curtain of every cryptocurrency transaction, every NFT sale, and every smart contract interaction—seeing not just the numbers, but the stories they tell. This is the power of on-chain analysis, a game-changing tool that transforms raw blockchain data into actionable insights.

In the fast-moving worlds of crypto and NFTs, where fortunes can be made or lost in minutes, understanding on-chain data is no longer optional—it’s essential. Whether you’re an investor tracking whale movements, a developer optimizing smart contracts, or an NFT collector gauging market sentiment, on-chain analysis provides the clarity needed to navigate this digital frontier.

But how does it work? Why does it matter? And what does the future hold? Let’s dive in.

—

The Power of On-Chain Analysis

1. Decoding Market Trends Like Never Before

Blockchains are public ledgers—every transaction is recorded, timestamped, and verifiable. This transparency allows analysts to track:

– Whale activity (large investors moving funds)

– Exchange inflows/outflows (signaling potential price shifts)

– Smart contract interactions (revealing DeFi & NFT trends)

For example, when Ethereum surged to $2,700, on-chain data revealed that DeFi protocols and NFT trading were major drivers[1]. Without this insight, investors might have missed the real story behind the rally.

2. Exposing Scams & Illicit Activity

Not all blockchain activity is legitimate. Rug pulls, wash trading, and money laundering happen—but on-chain analysis can spot them.

– Stephen Junior King’s investigation into NatDogs transactions exposed suspicious patterns in Doginals, protecting investors from potential scams[3].

– Tracking stolen funds (like hacked exchanges or phishing attacks) becomes possible by following the money trail.

3. Boosting Transparency for Crypto & NFT Projects

Projects that open their on-chain data build trust. ApeChain, for instance, provides full transparency for its ecosystem (AIP, ThriveProtocol, NFTs), letting users verify stats instead of relying on hype[2].

—

How On-Chain Analysis is Used Today

1. NFT Market Intelligence

NFTs are more than just digital art—they’re tradable assets with complex dynamics. On-chain tools help:

– Track sentiment: Are buyers bullish or bearish? Tools like Soon’s NFT sentiment analysis measure market mood[4].

– Assess rarity & value: Dynamic price floor analysis factors in traits to estimate true worth[6].

– Identify trends: Which collections are gaining traction? Which are fading?

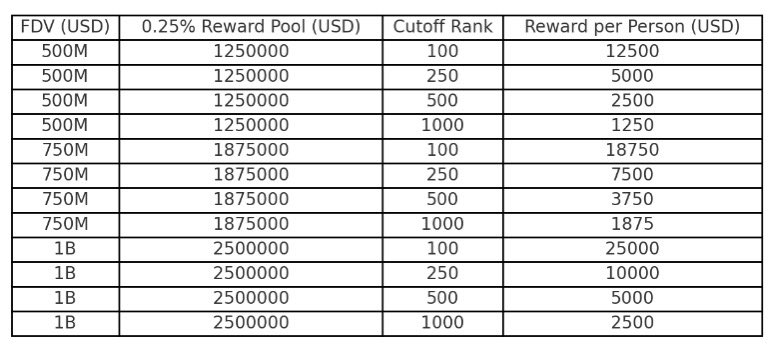

2. Airdrop & Reward Optimization

Airdrops (free token distributions) are a popular growth tactic—but who should get them? On-chain analysis helps:

– Identify active wallets (not just bots)

– Reward loyal users (like ZenFrogs’ GiveRep campaign on Sui)[7]

3. DeFi & Smart Contract Monitoring

DeFi protocols live and die by user activity. On-chain metrics reveal:

– TVL (Total Value Locked) – Is liquidity growing?

– User retention – Are people staying or leaving?

– Exploit risks – Are there vulnerabilities in the code?

—

The Future: AI, Cross-Chain, & Beyond

1. AI-Powered Predictive Analytics

Machine learning can detect patterns humans miss. Future tools might:

– Predict market crashes before they happen

– Automatically flag suspicious transactions

– Personalize investment strategies based on wallet history

2. Cross-Chain Identity Solutions

Blockchains are still siloed. Projects like SuiLink aim to connect identities across chains, making on-chain analysis even more powerful[8].

3. Mainstream Adoption

As crypto grows, regulators, institutions, and retail investors will demand better on-chain tools. Expect:

– More user-friendly dashboards

– Real-time alerts (e.g., “A whale just moved $10M BTC!”)

– Integration with traditional finance

—

Conclusion: The Data Revolution is Here

On-chain analysis isn’t just numbers on a screen—it’s the key to unlocking blockchain’s true potential.

– For investors: It’s due diligence made easy.

– For developers: It’s feedback in real time.

– For collectors: It’s a way to spot the next big NFT trend.

As AI and cross-chain tech evolve, the next wave of crypto innovation will be driven by data. The question is: Will you be left guessing—or will you learn to read the chain?

—

Sources

[1]: HarSpider Capital on Ethereum’s Rally

[2]: ApeChain’s Transparency Push

[3]: Stephen Junior King’s Scam Investigation

[4]: Soon’s NFT Sentiment Analysis

[6]: Dynamic NFT Price Floor Analysis

[7]: ZenFrogs & GiveRep Airdrops

[8]: SuiLink’s Cross-Chain Vision