The Current State and Future Prospects of Bitcoin in 2025

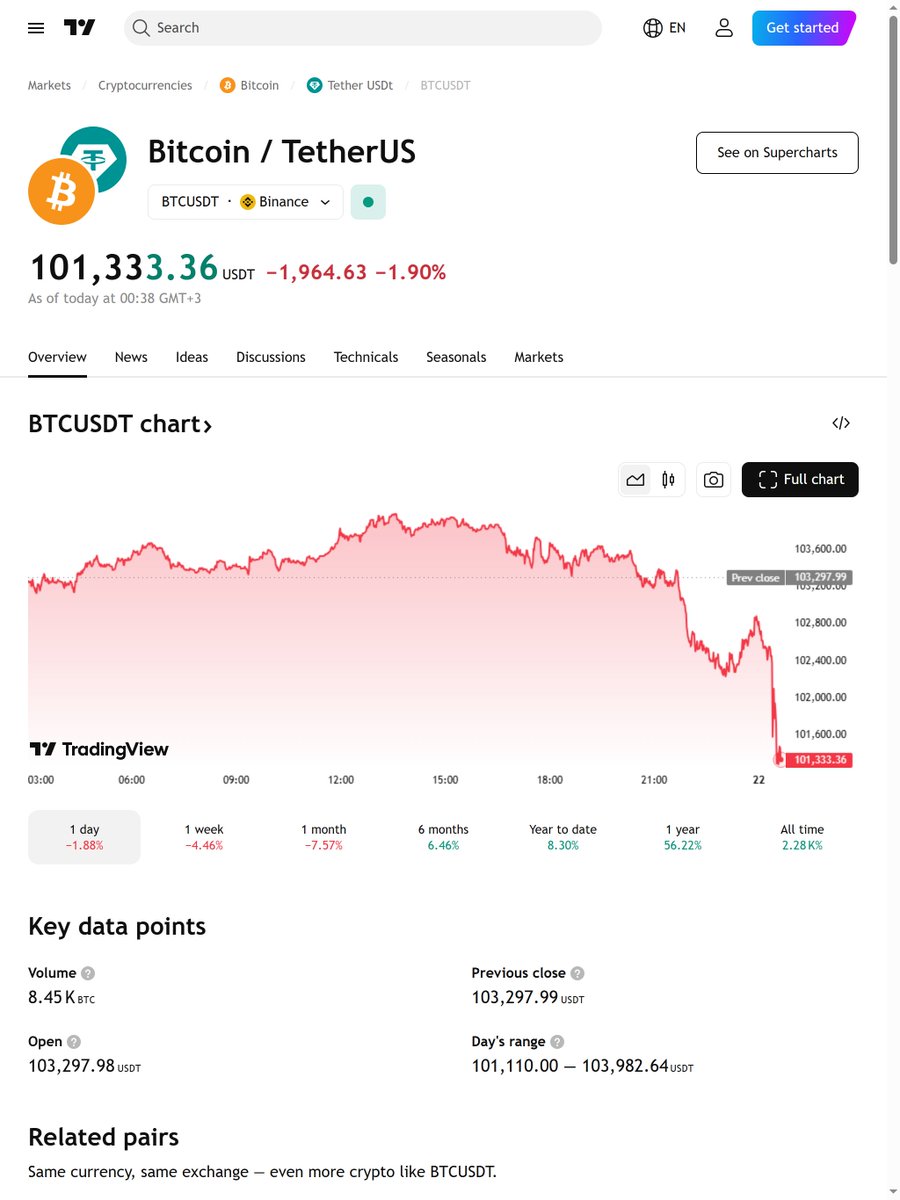

Imagine a world where digital currency is as common as fiat money. This is not a distant dream but a reality unfolding before our eyes. Bitcoin, the pioneer of cryptocurrencies, continues to captivate the financial world with its volatility, innovation, and potential. As of May 13, 2025, Bitcoin is trading at approximately $103,484, a figure that reflects years of technological advancements, market dynamics, and investor sentiment. But what does the future hold for this digital gold? Let’s delve into the current state and future prospects of Bitcoin.

Bitcoin’s Market Performance

Recent Trends and Patterns

Bitcoin’s price movements have been a rollercoaster ride, full of surprises and opportunities. Analysts have identified various patterns, such as ascending triangle formations and bullish displacement, which have significantly influenced market behavior. For instance, Bitcoin has been trading within an ascending triangle pattern, facing rejection from the horizontal supply zone at the top of the pattern. This pattern suggests a potential breakout, which could lead to substantial price movements.

The Ichimoku Cloud, a widely-used technical analysis tool, has been providing strong support below, reinforcing the structure and indicating a bullish trend. This support is crucial as it helps maintain the upward momentum despite occasional rejections at the supply zone.

Key Levels and Resistance

As of the latest analysis, Bitcoin is facing key resistance levels at $104,519 and $106,072. These levels are significant as they represent strong 1-day (1D) zones and major supply areas. A breakout above these levels could signal a strong bullish trend, potentially pushing Bitcoin to new all-time highs. Understanding these resistance levels is essential for investors looking to capitalize on potential price movements.

Market Sentiment and Analysis

Bullish vs. Bearish Sentiments

The market sentiment for Bitcoin is a mix of optimism and caution. Some analysts predict a strong multi-week rally for altcoins, citing a historic bullish divergence in their market cap relative to Bitcoin. This divergence suggests that altcoins could outperform Bitcoin in the short term, providing investors with alternative opportunities. However, this does not diminish Bitcoin’s long-term potential.

On the other hand, there are concerns about a potential cool-off period. Bitcoin has shown strength above the $100K mark, but recent volatility has raised questions about its sustainability. Some analysts believe that a pullback is imminent, which could provide a better entry point for long-term investors. This duality in market sentiment highlights the importance of staying informed and adaptable.

Institutional and Retail Investor Behavior

Institutional investors, particularly businesses, have been the biggest net buyers of Bitcoin in 2025. Michael Saylor’s strategy, which involves converting corporate cash reserves into Bitcoin, accounts for a significant portion of this growth. This institutional adoption is a bullish signal, as it indicates a long-term commitment to Bitcoin as a store of value.

Retail investors, on the other hand, have been more cautious. The recent volatility has led to a mix of buying and selling, with some investors taking profits and others accumulating more Bitcoin. This behavior is typical in a maturing market, where investors seek to balance risk and reward. Understanding the behavior of both institutional and retail investors is crucial for navigating the Bitcoin landscape.

Technical Indicators and On-Chain Data

On-Chain Analysis

On-chain data provides valuable insights into Bitcoin’s market dynamics. For instance, the $2 trillion market cap has attracted a wave of new buyers to the market, while seasoned traders turn cautious. This data suggests that Bitcoin’s price movements are influenced by both new and experienced investors, creating a dynamic market environment. On-chain analysis helps investors understand the underlying factors driving Bitcoin’s price movements.

Technical Indicators

Technical indicators such as the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI) have been providing mixed signals. The MACD shows a bullish crossover, indicating a potential upward trend, while the RSI suggests that Bitcoin is overbought. These conflicting signals highlight the importance of a comprehensive analysis that considers both technical and fundamental factors. Investors should use a combination of technical indicators and on-chain data to make informed decisions.

Future Prospects and Predictions

Short-Term Outlook

In the short term, Bitcoin’s price movements will likely be influenced by technical factors such as support and resistance levels, as well as market sentiment. A breakout above the key resistance levels could lead to a significant price increase, while a pullback could provide a better entry point for investors. Staying informed about these technical factors is essential for short-term trading strategies.

Long-Term Outlook

Looking ahead, Bitcoin’s long-term prospects remain bullish. The increasing institutional adoption, coupled with the growing acceptance of Bitcoin as a store of value, suggests that Bitcoin’s price could continue to appreciate. However, investors should be prepared for volatility and potential corrections along the way. The long-term outlook for Bitcoin is promising, but it requires a strategic and patient approach.

Conclusion: Navigating the Bitcoin Landscape

Bitcoin’s journey in 2025 is a testament to its resilience and potential. As we navigate the complexities of the cryptocurrency market, it is essential to stay informed and adaptable. Whether you are a seasoned investor or a newcomer, understanding the current state and future prospects of Bitcoin can help you make informed decisions and capitalize on the opportunities that lie ahead.

As Bitcoin continues to evolve, one thing is certain: the future is bright, and the possibilities are endless. So, buckle up and get ready for the ride, because the Bitcoin revolution is far from over.

Sources

– JJMaTrader

– PrimeXBitcoin

– Pakistani HODL

– TheRealPlanC

– BitcoinBottomTop

– DanCote303

– Daily Bitcoin Analysis

– SammysAnalysis

– CryptoBuletin8

– Dynamite_Fix

– Dex-Trade

– Leontrades

– CryptoPulse

– Robert cipher

– Dexplorer_10x

– Bitcoin Magazine NL

– Imperfect_Llex

– Andrea Souza

– MARLON_GOLDM

– LumenProto

– Keyanb