The Ever-Evolving Landscape of NFTs and Cryptocurrency

The Rise of NFTs and Cryptocurrency

A New Era of Digital Assets

Imagine owning a piece of digital art that can’t be replicated or replaced. That’s the power of non-fungible tokens (NFTs). Unlike cryptocurrencies, which are interchangeable, NFTs are unique digital assets verified using blockchain technology. This uniqueness makes them perfect for digital art, collectibles, and even real-world assets like property. The concept of digital ownership is revolutionizing industries, from art to gaming, and even real estate.

Market Trends and Analysis

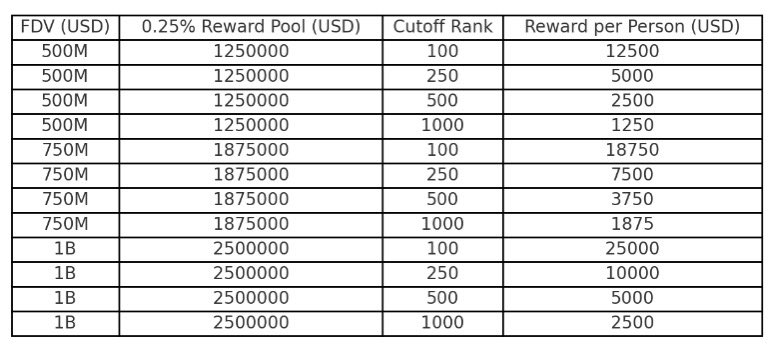

The NFT market has seen a meteoric rise, with platforms like OpenSea and Rarible becoming synonymous with digital collectibles. In 2024, the NFT market witnessed a staggering $25 billion in trading volume, a 300% increase from the previous year. This surge is fueled by several factors: the growing acceptance of digital art, the rise of metaverse platforms, and the increasing interest in blockchain technology[1].

Cryptocurrencies, on the other hand, have been the backbone of the digital economy for over a decade. Bitcoin, the pioneer, reached an all-time high of $100,000 in 2024. Other cryptocurrencies like Ethereum, Solana, and Cardano have also gained significant traction, each offering unique features and use cases. Ethereum, for instance, is the go-to blockchain for NFTs, while Solana boasts high transaction speeds.

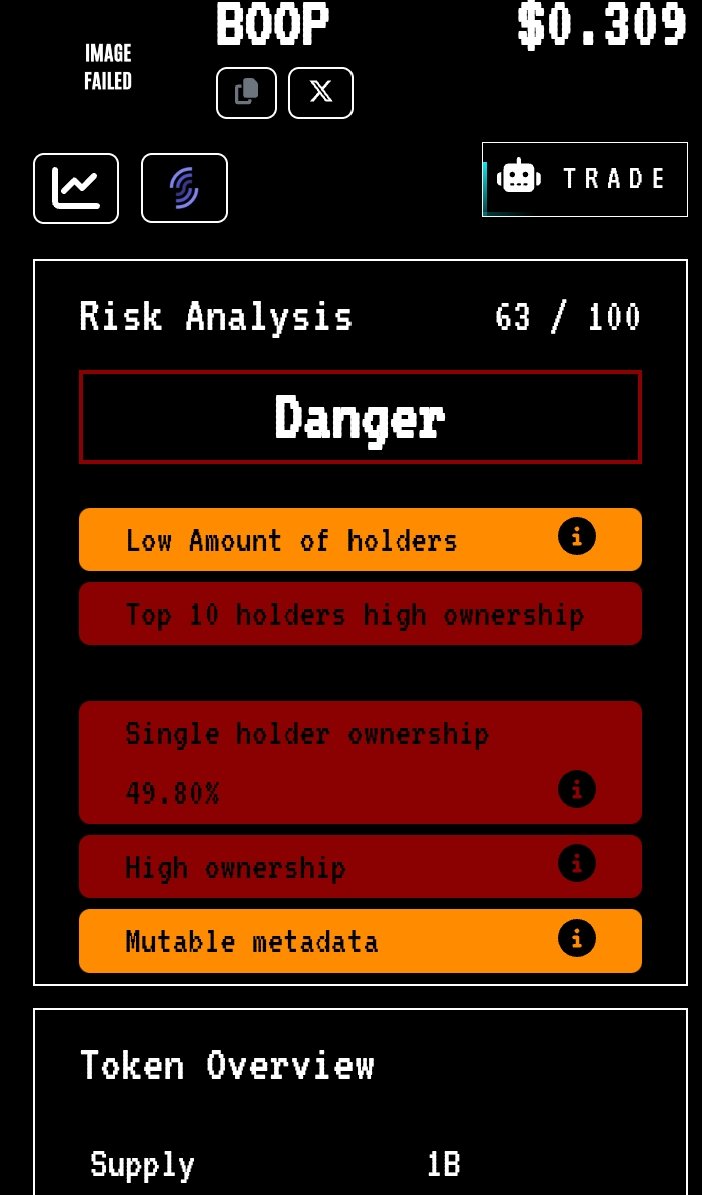

Navigating the Risks

Understanding Market Volatility

The digital asset market is notorious for its volatility. Prices can swing wildly based on market sentiment, regulatory changes, and technological advancements. For example, Bitcoin’s value dropped by 20% in a single day in March 2025 due to regulatory concerns in the United States[3]. Such volatility can be a double-edged sword, offering high rewards but also significant risks.

Security and Fraud

Security is a major concern in the digital asset space. NFTs and cryptocurrencies are stored in digital wallets, which can be vulnerable to hacking and theft. High-profile hacks, like the one that resulted in the loss of $600 million worth of cryptocurrency from a decentralized finance (DeFi) platform in 2024, underscore the need for robust security measures[4].

Regulatory Challenges

Regulatory uncertainty is another significant risk factor. Governments worldwide are still figuring out how to regulate these digital assets. In the United States, the Securities and Exchange Commission (SEC) has been increasingly scrutinizing cryptocurrency exchanges and NFT platforms, leading to uncertainty and potential legal challenges for market participants[2].

Strategies for Mitigating Risks

Diversification and Hedging

Diversification is key to mitigating risks in the NFT and cryptocurrency markets. Investors should spread their investments across different types of digital assets, including various cryptocurrencies and NFTs. Hedging strategies, such as using derivatives, can also help protect against price fluctuations. For instance, investing in stablecoins, which are pegged to traditional currencies, can provide a buffer against market volatility.

Enhanced Security Measures

Implementing robust security measures is crucial. This includes using hardware wallets, enabling two-factor authentication, and regularly updating software. Investors should also be wary of phishing scams and other fraudulent activities. Education and awareness are the first lines of defense against such threats.

Staying Informed and Adaptable

Staying informed about market trends and regulatory changes is essential. Investors should follow reputable sources of information, such as market analysis reports and industry news. Being adaptable and ready to pivot strategies based on new information can also help mitigate risks. For example, staying updated on regulatory changes can help investors anticipate market movements and adjust their portfolios accordingly.

The Future of NFTs and Cryptocurrency

Emerging Technologies and Innovations

The future of NFTs and cryptocurrency is bright, with several emerging technologies and innovations on the horizon. The integration of NFTs into the metaverse is expected to create new opportunities for digital ownership and interaction[5]. Additionally, advancements in blockchain technology, such as layer-2 solutions, are expected to improve scalability and reduce transaction costs[6].

The Role of Regulation

Regulation will play a crucial role in shaping the future of these markets. As governments around the world develop clearer regulatory frameworks, investors and market participants will have more certainty, leading to increased adoption and growth. However, it’s essential that regulations are balanced, promoting innovation while protecting investors.

Community and Collaboration

The community and collaboration within the NFT and cryptocurrency ecosystems are vital for their continued growth. Platforms like Twitter and Discord have become hubs for discussions, collaborations, and support. As seen in the tweets from users like @NftSei and @longpham2730, community engagement and support are essential for navigating the complexities of these markets.

Conclusion: Embracing the Future

The worlds of NFTs and cryptocurrency are filled with both opportunities and challenges. As we move forward, it’s crucial to stay informed, adaptable, and proactive in managing risks. By understanding market trends, implementing robust security measures, and staying engaged with the community, investors can navigate these dynamic markets successfully. The future of digital assets is bright, and those who embrace it with a strategic and informed approach will be well-positioned to reap the benefits.