The Ever-Changing Landscape of Bitcoin

Imagine a world where financial transactions are seamless, secure, and free from the constraints of traditional banking systems. This is the vision that Bitcoin, the pioneering cryptocurrency, has been working towards since its inception in 2009. From a niche interest among tech enthusiasts to a mainstream financial asset, Bitcoin has captured the imagination of investors, technologists, and economists alike. As we stand in 2025, the landscape of Bitcoin is more dynamic than ever, with innovations like Layer 2 solutions and cross-chain possibilities shaping its future.

The Rise of Decentralized Finance (DeFi)

Layer 2 Solutions: Enhancing P2P Lending

One of the most significant developments in the Bitcoin ecosystem is the growth of Decentralized Finance (DeFi). DeFi platforms aim to provide financial services without the need for traditional intermediaries, leveraging blockchain technology to facilitate peer-to-peer (P2P) transactions. Robin Obermaier, CEO of Liquidium, highlights the potential of Layer 2 solutions to enhance P2P lending. Layer 2 solutions, such as the Lightning Network, operate on top of the main Bitcoin blockchain, enabling faster and cheaper transactions. This innovation is crucial for scaling Bitcoin and making it more accessible for everyday use [1].

Layer 2 solutions address some of the key challenges faced by the Bitcoin network, such as scalability and transaction speed. By offloading transactions from the main blockchain, these solutions reduce congestion and lower fees, making Bitcoin more practical for everyday use. For instance, the Lightning Network allows for microtransactions, which are impractical on the main Bitcoin blockchain due to high fees and slow confirmation times. This makes it possible to use Bitcoin for small, everyday purchases, such as buying a cup of coffee or paying for a ride-share service.

Navigating Cross-Chain Possibilities

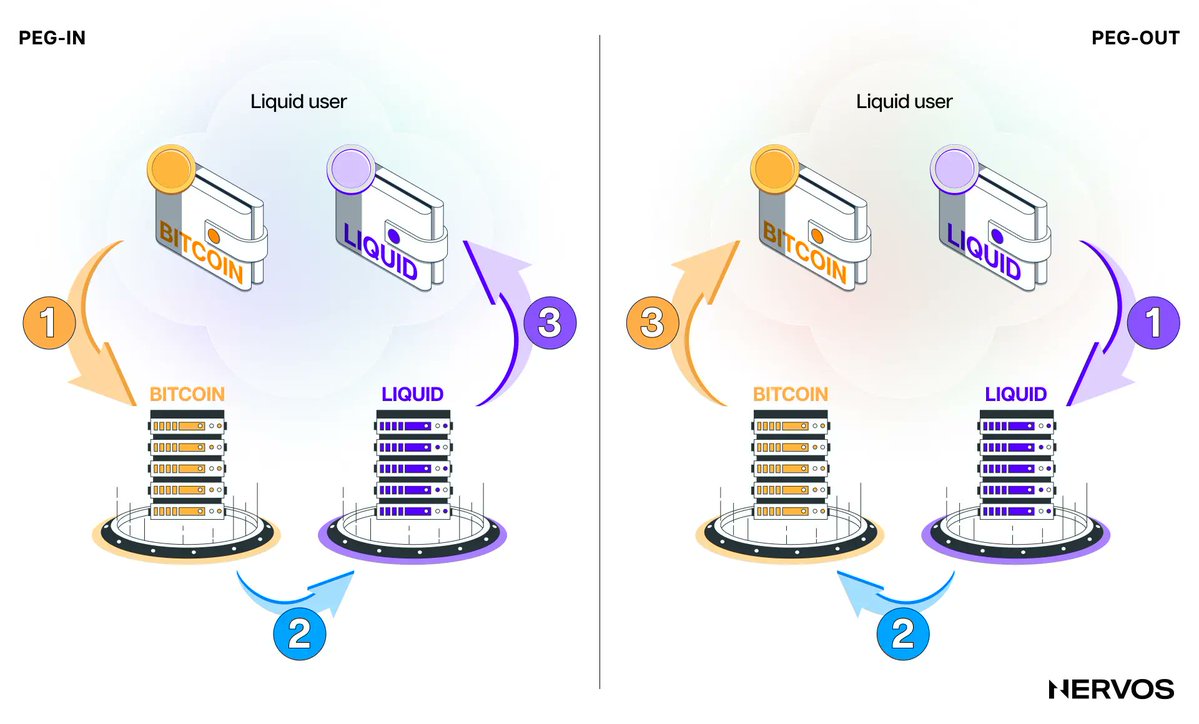

As the DeFi landscape evolves, navigating cross-chain possibilities becomes increasingly important. Cross-chain interoperability allows different blockchain networks to communicate and interact with each other, enabling the seamless transfer of assets and data. This interoperability is essential for creating a more integrated and efficient financial ecosystem. For Bitcoin, this means exploring ways to interact with other blockchain networks, such as Ethereum, to leverage their smart contract capabilities and expand the range of financial services available [1].

Cross-chain interoperability opens up a world of possibilities for Bitcoin. By interacting with other blockchain networks, Bitcoin can tap into the vast ecosystem of decentralized applications (dApps) and smart contracts. This allows for the creation of more complex financial instruments, such as decentralized exchanges (DEXs), lending platforms, and derivatives. For example, a Bitcoin-based DEX could allow users to trade Bitcoin for other cryptocurrencies without the need for a centralized intermediary, enhancing security and reducing the risk of hacks and fraud.

Technical Analysis: Bullish Momentum and Market Trends

Breaking Out of the Falling Wedge Pattern

Technical analysis provides valuable insights into Bitcoin’s price movements and market trends. Recently, Bitcoin has broken out of a falling wedge pattern with significant volume, indicating bullish momentum. A falling wedge pattern typically signals a reversal in a downtrend, and the breakout suggests that Bitcoin is poised for upward movement. A successful retest of the breakout zone would confirm this bullish trend, making it an exciting time for crypto enthusiasts [2].

The falling wedge pattern is a bullish reversal pattern that forms when the price of an asset makes lower lows and lower highs within a contracting range. The breakout from this pattern indicates that the downward pressure is weakening, and the price is likely to reverse and move higher. The significant volume accompanying the breakout adds to the strength of the signal, suggesting that there is strong buying interest driving the price upward.

Key Support and Resistance Levels

Understanding key support and resistance levels is crucial for predicting Bitcoin’s future price movements. Support levels are price points where buying pressure is strong enough to prevent the price from falling further, while resistance levels are where selling pressure is strong enough to prevent the price from rising. Analyzing these levels can help investors make informed decisions and optimize their portfolios. For instance, identifying macro support and resistance levels can provide a clearer picture of Bitcoin’s potential price range and help investors navigate market volatility [5].

Support and resistance levels are psychological barriers that traders and investors use to make decisions. Support levels act as a floor, preventing the price from falling further, while resistance levels act as a ceiling, preventing the price from rising further. By identifying these levels, investors can set stop-loss orders to limit potential losses and take-profit orders to lock in gains. For example, if Bitcoin is trading at a key support level, investors may see this as a buying opportunity, expecting the price to bounce back up. Conversely, if Bitcoin is approaching a key resistance level, investors may take profits, expecting the price to reverse and move lower.

Bitcoin vs. Gold: A Historical Evolution

Safe Havens in a Volatile Market

Bitcoin and gold have often been compared as safe havens in volatile markets. Both assets have historically been seen as stores of value, providing protection against inflation and economic uncertainty. However, their historical evolutions and market dynamics differ significantly. Bitcoin, being a digital asset, benefits from technological advancements and increasing adoption, while gold has a long-standing reputation as a tangible asset. Gain insights from detailed market analysis to optimize your portfolio and make smarter decisions with key data [8].

Bitcoin and gold serve similar purposes as safe havens, but they have different characteristics and market dynamics. Gold has been a store of value for thousands of years, with a proven track record of maintaining its value over time. It is a tangible asset that is widely accepted and recognized around the world. Bitcoin, on the other hand, is a relatively new asset that has gained popularity in recent years. It benefits from technological advancements, such as blockchain technology, which enhances its security and transparency. Additionally, Bitcoin’s supply is fixed, with a maximum of 21 million coins that will ever be mined, making it a deflationary asset.

Optimizing Your Portfolio

Investors often consider diversifying their portfolios with both Bitcoin and gold to balance risk and reward. While Bitcoin offers the potential for high returns, it is also more volatile. Gold, on the other hand, provides stability but may not offer the same level of growth. By understanding the historical evolution and market dynamics of both assets, investors can make more informed decisions and optimize their portfolios for better performance [8].

Diversification is a key strategy for managing risk in an investment portfolio. By including both Bitcoin and gold, investors can balance the potential for high returns with the need for stability. Bitcoin’s volatility can provide significant gains, but it also comes with the risk of substantial losses. Gold, on the other hand, is a more stable asset that can provide a hedge against market volatility and inflation. By allocating a portion of their portfolio to each asset, investors can achieve a more balanced risk-return profile. For example, an investor might allocate 50% of their portfolio to Bitcoin and 50% to gold, or adjust the allocation based on their risk tolerance and investment goals.

The Future of Bitcoin: Projections and Opportunities

Bullish Projections and Market Sentiment

The future of Bitcoin looks promising, with bullish projections and positive market sentiment. As more institutions and individuals adopt Bitcoin, its value and utility are likely to increase. The ongoing development of Layer 2 solutions and cross-chain interoperability will further enhance Bitcoin’s scalability and functionality, making it a more attractive option for a wider range of users [1].

The bullish projections for Bitcoin are driven by several factors, including increasing adoption, technological advancements, and regulatory clarity. As more institutions and individuals adopt Bitcoin, its value and utility are likely to increase. Additionally, the ongoing development of Layer 2 solutions and cross-chain interoperability will enhance Bitcoin’s scalability and functionality, making it a more attractive option for a wider range of users. For example, the Lightning Network and other Layer 2 solutions will enable faster and cheaper transactions, making Bitcoin more practical for everyday use. Cross-chain interoperability will allow Bitcoin to interact with other blockchain networks, expanding its range of applications and use cases.

Opportunities for Investors

For investors, the current landscape presents numerous opportunities. Whether it’s through direct investment in Bitcoin, participation in DeFi platforms, or leveraging technical analysis to make informed trading decisions, there are multiple avenues to explore. The key is to stay informed, adapt to market changes, and take advantage of the evolving technologies and trends in the Bitcoin ecosystem [1, 2, 5, 8].

Investors have several options for participating in the Bitcoin ecosystem. Direct investment in Bitcoin is the most straightforward approach, allowing investors to benefit from price appreciation. Participation in DeFi platforms offers the opportunity to earn yields through lending, staking, and other financial services. Leveraging technical analysis can help investors make informed trading decisions, identifying key support and resistance levels and market trends. Additionally, investors can explore other avenues, such as mining, developing decentralized applications, or providing liquidity to decentralized exchanges. The key is to stay informed and adapt to the evolving technologies and trends in the Bitcoin ecosystem.

Conclusion: Embracing the Future of Bitcoin

As we look ahead, it is clear that Bitcoin’s journey is far from over. The innovations in DeFi, the potential of Layer 2 solutions, and the increasing importance of cross-chain interoperability are all shaping the future of this groundbreaking technology. For investors, enthusiasts, and technologists, the opportunities are vast and exciting. Embracing these changes and staying informed will be crucial for navigating the dynamic landscape of Bitcoin and capitalizing on its potential.

The future of Bitcoin is bright, with numerous innovations and opportunities on the horizon. By staying informed and adapting to the evolving technologies and trends, investors, enthusiasts, and technologists can capitalize on the potential of Bitcoin and contribute to its continued growth and success. Whether it’s through direct investment, participation in DeFi platforms, or leveraging technical analysis, there are multiple avenues to explore in the dynamic landscape of Bitcoin. Embracing these changes and staying informed will be key to navigating the future of Bitcoin and realizing its full potential.

—

Sources: