The Intersection of Blockchain, NFTs, and Predictive Analysis

Imagine a world where digital assets aren’t just collectibles, but tools that can predict market trends, stabilize value, and even influence real-world events. This isn’t a distant dream, but a reality that’s slowly unfolding as blockchain technology, NFTs, and predictive analysis converge. Let’s dive into this fascinating intersection and explore how it’s shaping the future.

The Evolution of NFTs: From Art to Utility

Non-fungible tokens (NFTs) have come a long way since their inception. Initially, they were seen as digital collectibles, with the most notable example being the sale of Beeple’s “Everydays: The First 5000 Days” for $69 million. However, the landscape is shifting, and NFTs are now being used for much more than just digital art.

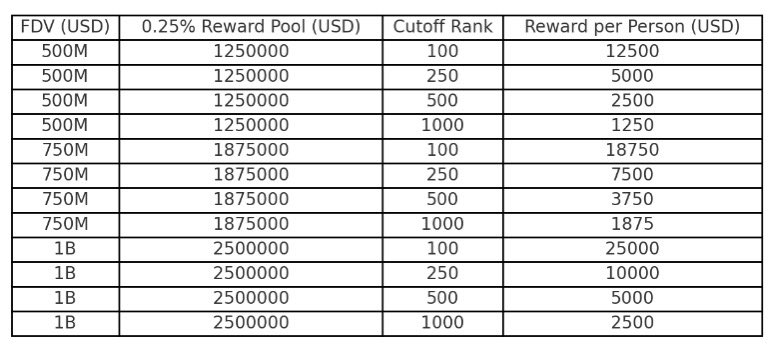

Layered Utility Buybacks and Burns

One innovative approach is the introduction of layered utility buybacks and burns. Projects like BEMU are exploring this concept, aiming to stabilize the value of their tokens. By buying back and burning tokens, they reduce the circulating supply, potentially increasing the value of the remaining tokens. This mechanism can provide a sense of security and stability to investors, making NFTs a more viable option for long-term investment.

NFT Airdrops and P2E Gaming

Another exciting development is the integration of NFT airdrops with play-to-earn (P2E) gaming. This strategy not only attracts gamers but also creates a community of engaged users who can benefit from the value appreciation of their in-game assets. KiX Sports NFT Exchange is a prime example, where in-game achievements can lead to real-world rewards, blurring the lines between virtual and physical economies.

The Power of Predictive Analysis

Predictive analysis is another game-changer in the world of digital assets. By aggregating sentiment and quantitative data, it’s possible to gain unique insights into market trends and consumer behavior. This technology is being teased by projects like BEMU, hinting at a future where digital assets can predict and influence market movements.

Sentiment Analysis

Sentiment analysis involves gauging public opinion from text data. In the context of NFTs and cryptocurrencies, this could mean analyzing social media posts, news articles, and forum discussions to predict market sentiment. For instance, a sudden surge in positive sentiment could indicate an upcoming price rally, while negative sentiment might signal a downturn.

Quantitative Data Aggregation

Quantitative data, on the other hand, involves hard numbers and statistics. This could include trading volumes, price movements, and other market data. By aggregating and analyzing this data, it’s possible to identify patterns and trends that can inform investment decisions. For example, a sudden spike in trading volume could indicate increased market interest, potentially leading to a price increase.

The Future of Digital Assets

As blockchain technology, NFTs, and predictive analysis continue to evolve, the future of digital assets looks increasingly promising. We’re moving towards a world where digital assets aren’t just collectibles, but powerful tools that can influence real-world events and provide unique insights into market trends.

The Rise of Omnichain and DeFi

The rise of omnichain technology and decentralized finance (DeFi) is another exciting development. Omnichain allows for seamless interaction between different blockchain networks, while DeFi provides financial services without the need for traditional intermediaries. Together, they’re creating a more interconnected and accessible digital economy.

The Role of AI and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are also playing a significant role in this evolution. They’re enabling more sophisticated predictive analysis, allowing for more accurate market predictions and better-informed investment decisions. For instance, AI-powered trading bots can analyze vast amounts of data in real-time, making split-second decisions that can maximize profits.

Conclusion: Embracing the Future

The convergence of blockchain, NFTs, and predictive analysis is ushering in a new era of digital assets. As we’ve explored, this intersection is leading to innovative solutions like layered utility buybacks, NFT airdrops, and advanced predictive analysis. The future of digital assets is bright, and it’s up to us to embrace these changes and harness their potential.

So, are you ready to dive into this exciting world? The future of digital assets is here, and it’s more accessible than ever. Whether you’re a seasoned investor or a curious newcomer, there’s a place for you in this evolving landscape. The only question is, are you ready to take the leap?