The Rise and Fall of Meme Coins: A Cautionary Tale of Greed, Hype, and Hubris

Introduction

In the wild west of cryptocurrencies, meme coins have emerged as a unique and often controversial phenomenon. These coins, inspired by internet memes or popular culture, have captivated investors and the public alike, promising astronomical returns and a good laugh. However, their meteoric rises and spectacular falls have raised serious questions about their legitimacy and the role of key figures behind them. One such figure is Hayden Davis, a self-proclaimed ‘facilitator’ who has been linked to the creation and promotion of two high-profile meme coins, LIBRA and WOLF, and their subsequent crashes.

The LIBRA Phenomenon

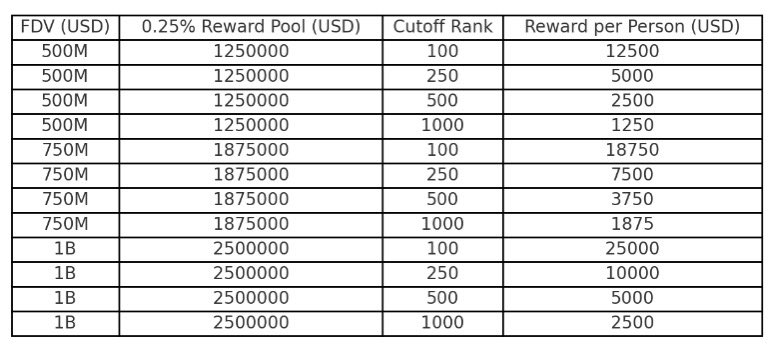

Hayden Davis first made waves in the crypto world with the launch of the LIBRA meme coin in 2020. The coin, named after the Facebook-backed stablecoin that never was, quickly gained traction. LIBRA’s unique branding, featuring the iconic ‘Keep Calm and Carry On’ poster with ‘HODL’ instead of ‘Carry On’, resonated with investors. The coin’s market cap soared, reaching a peak of over $1 billion [1]. However, not everyone was impressed. Critics accused Davis of insider manipulation and market manipulation, alleging that he had created multiple accounts to pump and dump the coin [2]. Davis denied these allegations, but the controversy surrounding LIBRA persisted.

The WOLF Crash

Fast forward to 2023, and Davis finds himself at the center of another crypto storm. This time, it’s the WOLF memecoin, a token that briefly spiked to a market cap of $43 million before crashing spectacularly. The crash resulted in losses of over $40 million for investors [3]. Blockchain data platform Bubblemaps claimed to trace the WOLF memecoin’s origins to the same wallet Davis had used to launch other tokens, including LIBRA [4]. The crypto community was quick to draw parallels between the two coins, with many accusing Davis of repeating his alleged tactics from the LIBRA saga.

The Aftermath

The fallout from the WOLF crash has been significant. An Argentine prosecutor has reportedly asked a judge to issue an Interpol Red Notice for Davis, alleging market manipulation and fraud [5]. Meanwhile, the crypto community has been left questioning the legitimacy of meme coins and the role of key figures in their creation and promotion. The incident has also raised concerns about the lack of regulation in the crypto market, with some calling for stricter rules to prevent such crashes in the future [6].

The Psychology Behind Meme Coins

To understand the allure of meme coins, one must look beyond their unique branding and promises of high returns. Meme coins tap into the human psyche, exploiting our desire for social status, fear of missing out (FOMO), and herd mentality. They create a sense of community, with investors banding together to ‘ride the wave’ of a coin’s popularity. However, this communal spirit can quickly turn into a stampede when the coin’s value starts to drop.

The Role of Influencers and Promoters

Influencers and promoters play a significant role in the rise and fall of meme coins. They can pump up a coin’s value with a single tweet or post, drawing in new investors and driving up demand. However, their influence can also be a double-edged sword. When they abandon a coin, as many did with WOLF, the resulting sell-off can cause the coin’s value to plummet [7].

The Future of Meme Coins

The story of LIBRA and WOLF serves as a cautionary tale for investors and the crypto community. While meme coins can offer the promise of high returns, they also come with significant risks. As the crypto world continues to evolve, it is crucial that investors and regulators alike remain vigilant against insider manipulation, market manipulation, and the hype-driven nature of meme coins. Only then can we ensure the long-term health and sustainability of the crypto market.

Conclusion: A Call for Caution and Regulation

The rise and fall of meme coins are a stark reminder of the volatile and unpredictable nature of the crypto market. While these coins can offer exciting opportunities, they also pose significant risks. As we move forward, it is essential that we approach meme coins with caution, conducting thorough research and remaining aware of the psychological factors that can influence our investment decisions. Moreover, regulators must play their part in creating a more robust and transparent crypto market, one that protects investors and promotes long-term growth.

Sources:

– [1] LIBRA token ‘facilitator’ Hayden Davis connected to $40 million crash of ‘WOLF’ memecoin: Bubblemaps

– [2] LIBRA token ‘facilitator’ Hayden Davis connected to $40 million crash of ‘WOLF’ memecoin: Bubblemaps

– [3] WOLF Token Surges 1000% Amid Insider Manipulation Allegations

– [4] LIBRA token ‘facilitator’ Hayden Davis connected to $40 million crash of ‘WOLF’ memecoin: Bubblemaps

– [5] Hayden Davis Embroiled in New Memecoin Fiasco Amidst Legal Heat from Argentina

– [6] LIBRA Creator Hayden Davis Linked to WOLF Meme Coin

– [7] The Psychology Behind Meme Coins