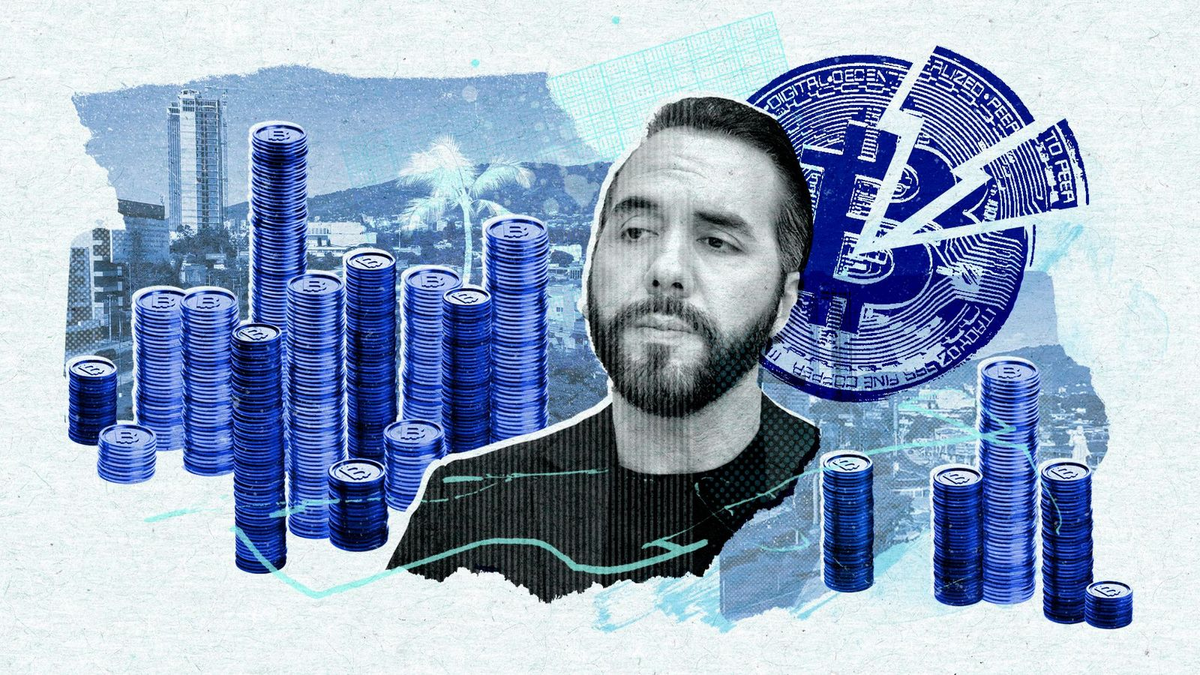

El Salvador’s Bitcoin Adventure: A Bumpy Ride

In 2021, El Salvador made a big splash by becoming the first country to make Bitcoin legal money. This was a huge deal, and many people thought it was a great idea. However, things didn’t go as smoothly as expected. Let’s look at what happened and why.

Getting Started with Bitcoin

El Salvador’s president, Nayib Bukele, wanted to attract more people to invest in his country and boost its economy. So, he thought making Bitcoin legal money would help. The government even created a special wallet called Chivo to make Bitcoin transactions easier. But even with all this effort, not many people used Bitcoin for buying things. Only about one in five Salvadorans used it for transactions[1][3].

Problems Along the Way

Technical Troubles and Safety Worries

One big problem was that the Chivo wallet had a lot of security issues. This made people worry about using Bitcoin for everyday stuff. Plus, there were technical problems like having a hard time changing Bitcoin into U.S. dollars and transactions not working properly[5].

Price Fluctuations and Economic Worries

In 2022, the price of Bitcoin went up and down a lot. This made El Salvador’s economy less stable. The government lost a lot of money because it had bought a lot of Bitcoin. On top of that, El Salvador’s public debt was growing, and it had a big hole in its budget. All these things made it hard for El Salvador to keep using Bitcoin[3].

Pressure from the International Monetary Fund (IMF)

The IMF told El Salvador to stop buying more Bitcoin and to stop supporting the Chivo wallet by July 2025. This was part of a deal where El Salvador got $1.4 billion in loans. Because of this, businesses don’t have to accept Bitcoin anymore; they can choose whether they want to or not[5].

What We Can Learn and What’s Next

The problems El Salvador had with Bitcoin can teach other countries a lot. It shows how important it is to have a strong financial system, clear rules, and to slowly introduce digital money. There might be better ways to use digital money, like digital money that central banks create (called CBDCs)[1].

What We Can Learn from El Salvador’s Experience

El Salvador’s Bitcoin adventure shows us that using cryptocurrencies in a country’s economy can be really hard. Even though the idea of using Bitcoin as money was new and exciting, it had too many problems. For digital money to work well, countries need to plan carefully, have strong systems, and work together internationally.

—

Sources:

– SSRN

– Happy Scribe

– TradingView

– Quorum Report

– YouTube